When your sales team closes deals, you want consistency—not five different reps taking five completely different approaches with prospects. 64% of sellers say they missed their most recent quota, which means most teams can’t afford to let every rep “do their own thing” in deals.

Sales methodologies like MEDDIC, SPIN Selling, Challenger Sale, and Gap Selling provide that structure and give your team proven frameworks to boost sales performance and reach more closed deals reliably.

The right methodology gives sales leaders clear data on what's working and helps new reps ramp faster. Choosing between enterprise qualification frameworks like MEDDIC versus consultative approaches like SPIN Selling depends on your deal size, sales cycle, and customer buying behavior.

In this article, we'll break down 17 sales methodologies, show you how to match each one to your team's needs, and walk through implementation steps that reduce ramp tim

What is a sales methodology?

A sales methodology is a framework that guides how your sales team moves prospects through the selling process. Methods like MEDDIC, SPIN Selling, Challenger Sale, and Gap Selling each define specific principles, questioning techniques, and tactics that help reps engage prospects, identify needs, and close deals.

Without a methodology, sales teams rely on individual rep instincts which means your top performer's close rate stays locked in their head while new hires struggle. A methodology codifies what works and turns one person's success into repeatable steps your entire team can follow.

Why implement a sales methodology

Sales reps close more deals when they follow a proven framework instead of winging every conversation. A methodology gives your team a shared playbook—the same qualification questions, objection responses, and discovery techniques that work across prospects.

A lack of structure is expensive—61% of sellers say administrative tasks and inefficient processes slow them down the most. A methodology reduces that noise by giving reps a repeatable sequence of steps so they spend less time figuring out “what to do next” and more time actually selling.

When everyone uses the same approach, your best practices scale. New hires learn faster because they're following documented steps instead of guessing. Managers can coach more effectively because they know exactly which methodology stage each rep needs help with.

And your team qualifies prospects more accurately, spending time on deals that actually close instead of chasing dead ends for months. Methodologies also create consistency. Instead of five reps pitching your product five completely different ways, everyone leads with the same value positioning and asks the same discovery questions.

Most organizations underestimate how inconsistent their sales motion actually is. Gong’s research shows only 38% have formal guidelines for how reps should use key tools and workflows—meaning the majority operate without standardization. A formal methodology closes that gap by ensuring every rep follows the same proven process.

Prospects get a coherent experience, and you get data on what's actually working versus what sounds good in theory.

How to choose the right sales methodology for your team

The right sales methodology depends on three factors: your deal size, how long prospects take to buy, and whether they need education or just evaluation.

For example:

- Enterprise deals over $100K with 6-18 month cycles need qualification frameworks like MEDDIC or MEDDPICC that identify decision-makers across multiple stakeholders.

- Mid-market deals ($25K-$100K, 3-6 months) work better with consultative approaches like SPIN Selling or Challenger Sale that uncover needs through questioning.

- Simple transactional sales under $25K benefit from streamlined methods like BANT that qualify quickly.

Kegan Croxford, Sales Director at Mentally Fit South Africa, explains:

“The "right sales methodology depends on your team, customers, and business goals. No methodology is a silver bullet, but you will set yourself up for success by choosing one that aligns with your team’s strengths and is flexible enough to grow with you.”

When choosing a methodology, consider these five factors:

1. What are your company goals?

Match your methodology to your growth priority: Market share growth needs aggressive prospecting (Challenger Sale), tight resources need early qualification (MEDDIC), retention focus needs relationship-building (Sandler, Gap Selling).

Your methodology should drive the specific outcome you need:

Aggressive sales prospecting works when you need volume and can afford some wasted effort.

Early qualification protects limited resources by focusing only on deals likely to close.

Relationship methods generate expansion revenue from existing customers rather than constantly hunting new ones.

2. How do your customers buy?

Technical buyers need discovery (SPIN, Solution Selling), fast-moving buyers need quick ROI proof (BANT, Challenger).

Match your sales motion to how prospects make decisions. Independent researchers have already formed opinions before contacting you—they need insights that challenge their thinking. Buyers who need guidance through complex decisions respond better to collaborative questioning and sales collateral that helps them discover their own requirements.

“Align your choice with the customer journey. If your clients are looking for quick solutions a methodology that emphasizes a simple decision-making process would be a good option. However, for longer cycles that focus on qualifying leads and understanding the decision-making, a methodology like MEDDIC may fit better. Match your methodology with how your customers buy. The methodology of choice should be able to scale with your business as you grow - Flexibility is key”.

Kegan Croxford, Sales Director

3. What are your team's current strengths?

Choose methodologies your team can execute now—Challenger needs confident reps, MEDDIC needs experienced enterprise sellers.

Junior sellers and relationship-focused cultures struggle with pushback required in Challenger Sale. Enterprise political navigation in MEDDIC overwhelms new hires unfamiliar with C-suite dynamics.

Start with a methodology that matches your team's current abilities, then train into more advanced approaches. A simple framework executed well beats a sophisticated methodology executed poorly.

4. What are your competitors doing?

Differentiate by contrasting your approach—if competitors use consultative selling, use Challenger's insight-led style (or vice versa).

When prospects hear identical discovery questions from three vendors, they tune out. Standing out with a contrasting approach attracts buyers frustrated with the standard sales experience they're getting elsewhere.

5. How complex is your product?

Simple products use BANT or transactional selling while complex products with multiple decision-makers need MEDDIC, Gap Selling, or proof-of-concept approaches.

Straightforward value propositions don't require elaborate qualification—prospects understand the benefit quickly. Custom configurations, long implementations, and stakeholder alignment across departments demand structured frameworks that track political dynamics and technical requirements. The more decision-makers involved, the more structured your methodology needs to be.

Kegan Croxford explains:

“The "right sales methodology depends on your team, customers, and business goals. No methodology is a silver bullet, but you will set yourself up for success by choosing one that aligns with your team’s strengths and is flexible enough to grow with you.”

That doesn’t mean it’s not worth trying them out and seeing which approach drives the best results. There’s always room for training and development, and with the right sales enablement, you can help anyone get better at applying a specific methodology.

But sometimes, the juice just isn’t worth the squeeze.

Giving your team tools to approach their sales conversations in a better way is a win for all.

More complex products benefit from an involved selling strategy, such as Gap selling, or a proof of concept sales approach.

What's working today

Before we dive into the full list of methodologies, we hosted Richard Harris, Founder @ The Harris Consulting Group and Nathan Clark, Director Global Sales Enablement @ UpGuard, to discuss popular sales methodologies and their relevance in the world of modern selling, with recommendations to maximize sales success.

We think it's a great conversation that adds color to what can be quite a nuanced topic:

Why it’s important to use the right sales methodology

The right methodology delivers three core benefits:

Faster onboarding: Documented frameworks give new reps clear processes to follow—specific qualification questions, objection responses, and discovery techniques—instead of figuring out what works through trial and error.

Better qualification: Frameworks like MEDDIC help teams identify bad-fit prospects early, reducing time spent on deals that won't close. Reps focus their effort on opportunities with real potential instead of chasing dead ends.

Scalability: As your team grows, new hires learn from proven processes instead of inventing their own approach. An established methodology maintains consistency as you add headcount.

17 popular sales methodologies to consider

Sales methodologies vary widely in what they offer and how sellers use them. Some define specific steps for the entire B2B sales process. Others are more suitable during one or more parts of the sales process like qualifying leads or closing deals. These types of methodologies don’t usually include steps to follow but rather suggest a general sales approach (like consultative selling) or questions to ask (such as Neil Rackham’s SPIN selling).

You can mix and match different methodologies and sales models based on your prospects, customers, industry, and sales strategy.

We'll cover:

Popular Sales Methodologies

- Gap Selling

- Challenger Selling

- MEDDIC

- MEDDPICC

- Sandler Sales

- Spin Selling

- Solution Selling

- Conceptual Selling

- Transactional Selling

- Consultative Selling

- Value Based Selling

- Proactive Sales

We'll also touch on:

1. Gap Selling

Gap Selling, created by Keenan (CEO of A Sales Growth Company, author of Gap Selling: Gap Selling: Getting the Customer to Yes, 2018), focuses on quantifying the gap between a prospect's current state and desired future state. Instead of taking buyers' words at face value, sales reps dig into the root cause of problems—showing prospects the cost of staying where they are versus the value of solving the issue.

Best for: Complex B2B sales with clear, measurable problems and longer sales cycles. Works well when prospects need help understanding the full impact of their current situation. Less effective for luxury or "nice to have" products.

Pro tip: Sales teams using Qwilr's Gap Selling proposal template can visualize the current-to-future state transformation with interactive before/after comparisons, helping prospects see the productivity gap your solution closes.

2. Challenger Selling

The Challenger Sale methodology, developed by CEB (now Gartner) researchers Brent Adamson and Matthew Dixon (2011 bestseller), teaches reps to challenge customer assumptions with insight-led sales conversations. Instead of responding to stated needs, sellers teach prospects something new about their business—reframing how they think about problems and solutions.

Best for: Complex B2B sales in technology, healthcare, and finance. Particularly effective during economic downturns when buyers resist spending, or when sales reps need to differentiate from competitors using consultative approaches and build trust with them.

Expert tip:

“My top tip for implementing the Challenger Sale methodology is to focus on training your sales team to confidently lead with insight and provide value upfront. This involves a mindset shift from simply "selling" to becoming a strategic partner who understands the client’s challenges better than the client themselves. Invest in customer research to also equip your team with insights that are relevant.”

Kegan Croxford, Sales Director at Mentally Fit South Africa

3. MEDDIC

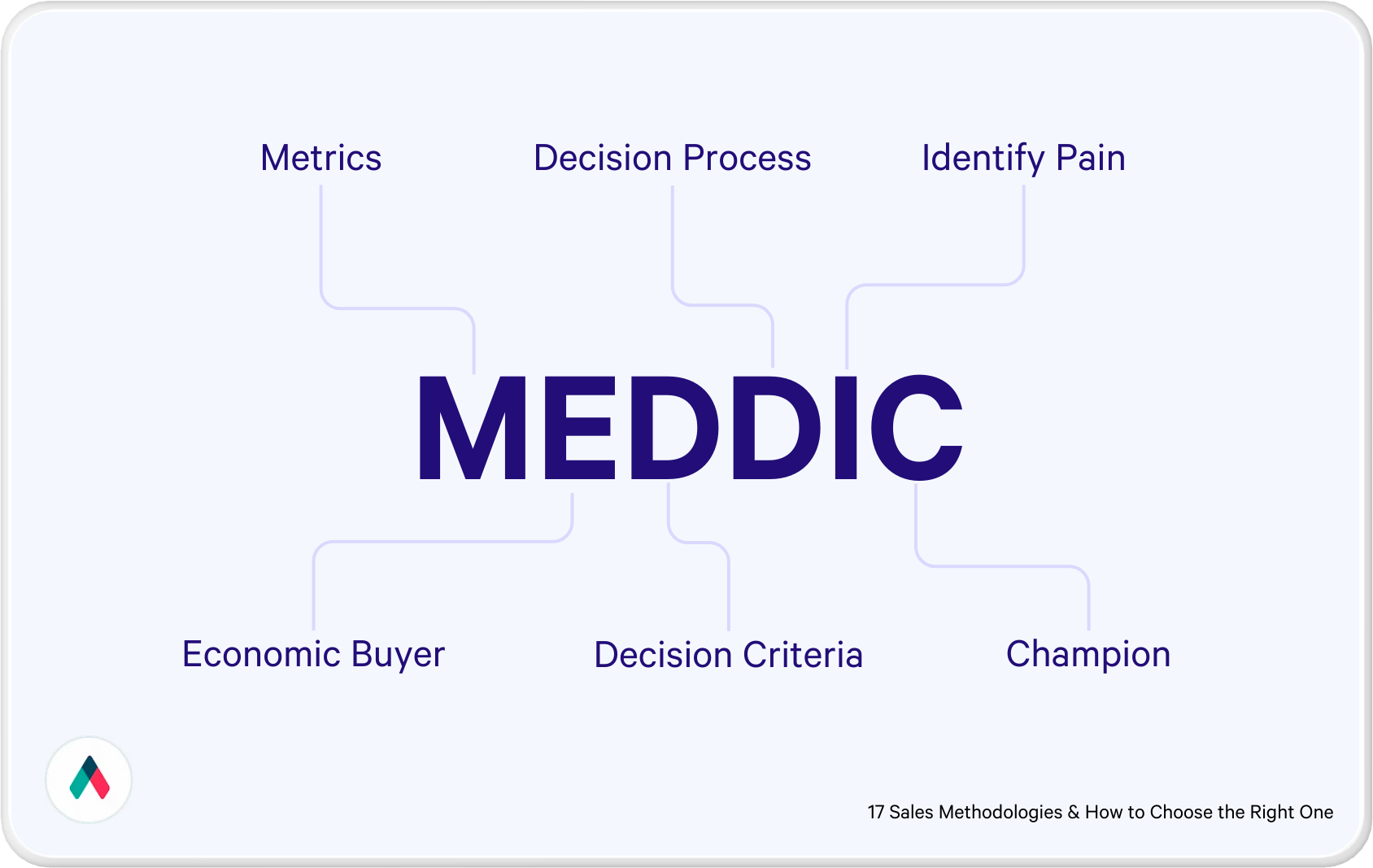

MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) was developed by Jack Napoli at PTC Software in 1996. It's a qualification framework that helps enterprise sales teams identify the economic buyer (the person who controls the budget), understand decision criteria, and find an internal champion who can advocate for your solution.

Best for: Enterprise sales and technology deals with specific ideal customer profiles. Works best as an early-stage qualification tool, often combined with other methodologies for later sales stages.

Pro tip: Enterprise teams using Qwilr's MEDDIC proposals can track which stakeholders (CFO, CTO, VP Operations) view which sections with built-in analytics.

Sales reps can then prioritize follow-up conversations with decision-makers who haven't engaged.

Read next: Command of the Message

4. MEDDPICC

MEDDPICC expands MEDDIC by adding Paper Process (tracking contracts, renewals, and legal requirements) and Competition (identifying competing solutions, including no-decision and status quo). The additions help sales teams manage the complexities of SaaS contracts and competitive industries.

Best for: SaaS and technology companies selling multi-year contracts that require renewal tracking and competitive differentiation strategies.

5. Sandler Sales

The Sandler Selling System, developed by David Sandler (1967, Sandler Training), uses seven steps:

- Bonding and rapport

- Up-front contract

- Pain

- Budget

- Decision

- Fulfillment

- Post-sell

The system creates low-pressure consultative sales conversations where prospects self-qualify through budget discussions ($50K+ deals) early in the process.

Best for: Complex deals in software, technology, managed services, and consulting where relationship-building and mutual qualification matter more than aggressive closing tactics.

6. SPIN Selling

SPIN Selling, created by Huthwaite researcher Neil Rackham (1988 book SPIN Selling, based on 12-year study of 35,000 sales calls), uses four question types to uncover prospect needs.

- Situation ('What CRM do you use?')

- Problem ('How often does data sync fail?')

- Implication ('What does 20% data loss cost monthly?')

- Need-Payoff ('How would real-time sync improve forecasting?'

The goal is to understand the prospect’s needs and decision criteria before making a sales pitch. It’s ideal for building credibility with prospects and discovering unmet needs.

Best for: Consultative sales in professional services, software, and complex B2B environments where discovery and needs-based selling drive success.

7. Conceptual Selling

Conceptual Selling focuses on selling the concept or idea behind your solution rather than product features. Success depends on deeply understanding prospect business goals and pain points, then positioning your product as the way to achieve those outcomes. Research, active listening, and personalization are critical.

Best for: Marketing, advertising, media, and creative industries where the "big idea" matters more than technical specifications.

8. Transactional Selling

Transactional selling focuses on closing deals quickly and efficiently without building long-term relationships. The goal is simple: complete the transaction and move to the next prospect. While often viewed as outdated, it works well for high-volume, low-complexity sales where speed and sales efficiency matter more than relationship-building.

Best for: Retail and e-commerce with frequent, low-value purchases. Not suitable for high-value products, SaaS, or complex B2B sales requiring relationship development.

9. Solution Selling

Solution selling (also called customer-centric selling), identifies customer pain points and positions your product as the solution. Rather than leading with product features, reps discover specific business challenges first, then show how their offering solves those problems. This approach improves targeting accuracy and builds long-term customer loyalty.

Best for: IT, healthcare, and finance where customers have specific business challenges requiring personalized solutions rather than off-the-shelf products.

10. Consultative Selling

Consultative selling positions sales reps as trusted advisors who collaborate with prospects to identify needs and develop tailored solutions. Reps act as industry experts who understand the prospect's business deeply, working together to find problems and opportunities. This requires highly skilled salespeople with deep industry knowledge and strong listening capabilities. It’s a great way to build customer trust and rapport, identify upsell and cross-sell opportunities, and improve the buying process.

Best for: Complex or technical products in software, technology, and professional services where expertise and trust-building drive purchase decisions.

11. Value-Based Selling

Value-based selling focuses on communicating ROI and business impact rather than competing on price. Reps highlight how their solution aligns with the customer's strategic objectives, quantifying the specific value delivered—whether efficiency gains, revenue growth, or cost reduction. Success requires a deep understanding of customer business goals and pain points.

Best for: Technology, healthcare, and B2B services where solutions deliver measurable, significant business impact that justifies premium pricing.

12. Proactive Sales

Proactive sales involves actively seeking and creating opportunities through outbound channels like cold calling, email, and social media, rather than waiting for inbound leads. Reps continuously research markets to identify potential targets and approach prospects with insights and solutions before they recognize a need themselves.

Best for: Competitive markets where waiting for leads isn't sustainable, or tech startups and innovative companies solving problems prospects don't yet know they have.

13. Enterprise Sales

Enterprise sales, sometimes called complex sales, involves selling to large organizations with complex buying committees, longer sales cycles (6-18+ months), and higher deal values. Success requires navigating multiple stakeholders, building consensus across departments, and managing political dynamics. While not a methodology itself, enterprise sales typically combines frameworks like MEDDIC, Challenger, or Miller Heiman’s Large Account Management Process (LAMP).

Best for: Organizations selling to enterprise customers, particularly in SaaS and technology, with multi-year deals exceeding $100K.

14. Proof of Concept

A Proof of Concept (POC) highlights your solution's viability through practical, hands-on trials that show how it addresses specific prospect pain points. POCs let prospects experience the product in their environment, visualizing implementation and adoption before committing. While not a standalone methodology, POCs work within other frameworks to bridge the gap between proposal and closed deal.

Best for: SaaS products, physical products, and training services that sales teams can summarize in short sessions to prove tangible benefits and applicability.

15. Target Account Selling

Target Account Selling (also called Account-Based Sales) focuses on building relationships with a pre-selected list of high-priority accounts rather than broad prospecting. Sales and marketing teams collaborate to create highly customized messaging and campaigns for specific target buyers, often at the individual company level. This approach requires significant research and personalization but delivers higher-value customers.

Best for: Enterprise and mid-market sellers targeting specific niches or strategic accounts where deal sizes justify the investment in customization and relationship-building.

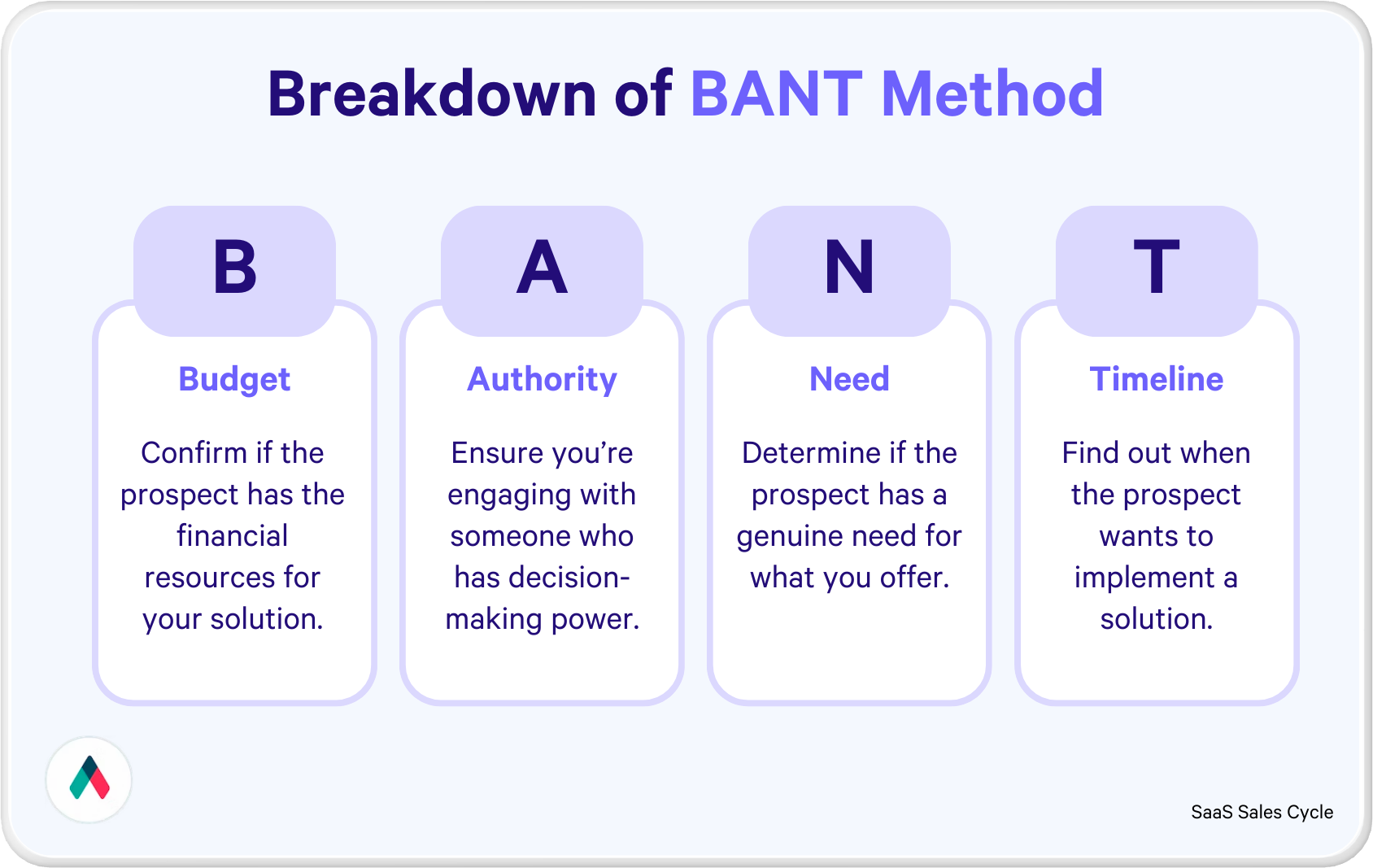

16. BANT

BANT, (Budget, Authority, Need, Timeline) is a qualification framework that helps reps quickly assess whether prospects are ready to buy. Reps verify prospects have budget allocated, access to decision-makers, a clear need, and a defined purchase timeline. While simple to implement, BANT's upfront focus on budget and authority can deter early-stage prospects not ready for those conversations.

Best for: High-volume, transactional B2B sales with shorter cycles and lower complexity. Less effective than MEDDIC or MEDDPICC for enterprise deals requiring deeper qualification.

17. N.E.A.T

N.E.A.T. (Needs, Economic Impact, Access to Authority, Timeline) is a modern qualification framework that explores prospect needs and challenges, quantifies potential ROI and cost savings, identifies decision-makers, and establishes buying timelines. It offers a broader, more consultative approach to qualification than BANT's binary checklist.

Best for: Complex, consultative B2B sales where understanding buyer challenges and aligning solutions to business impact matters more than quick yes/no qualification.

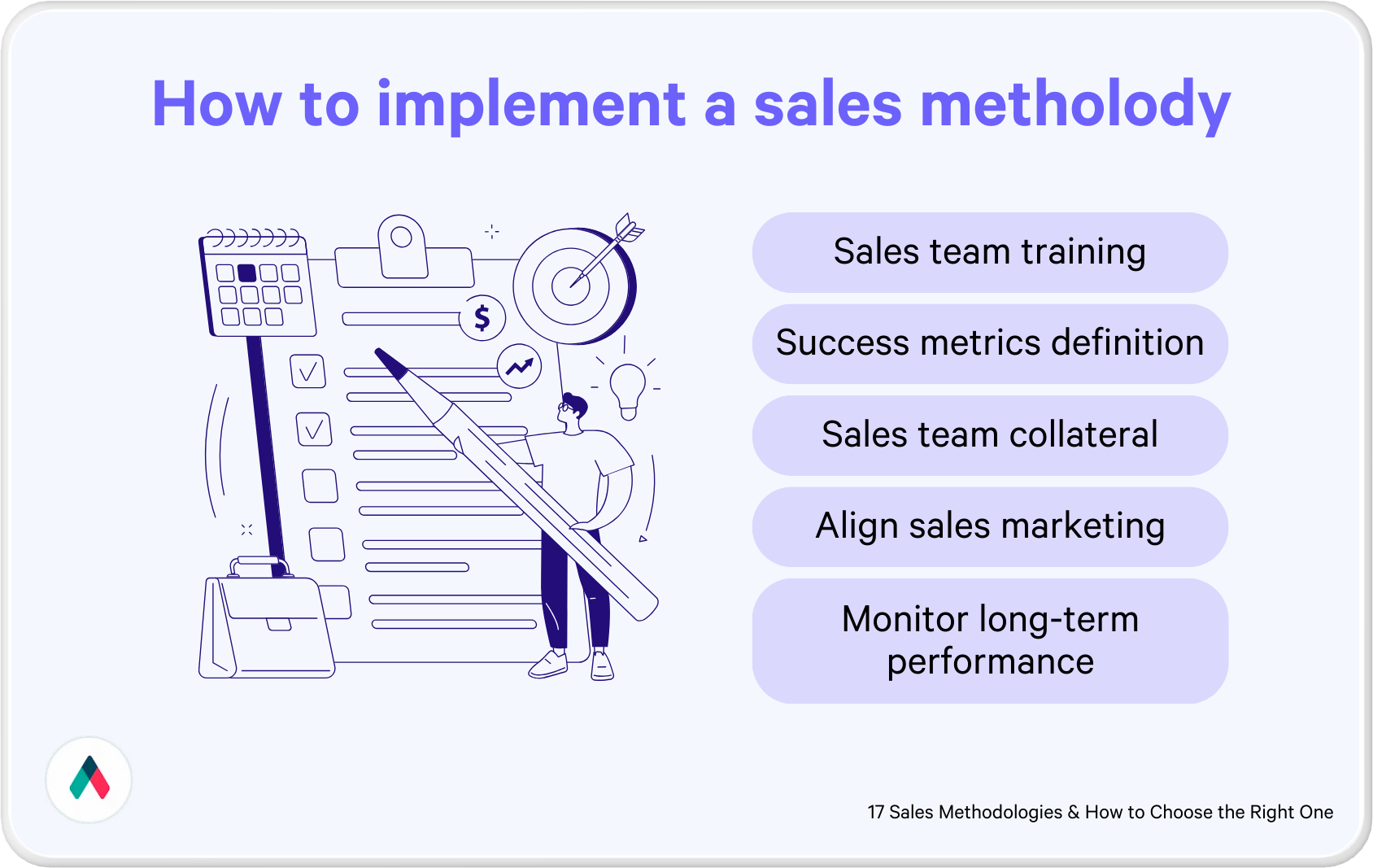

How to implement a new sales methodology

Implementing a new sales methodology typically takes three to six months, including baseline analysis, training development, rollout, and adoption monitoring. Sales leaders can achieve quick wins in 30 to 60 days with focused training on key methodology components.

Check out these top tips.

Identify your baseline

Collect data on current conversion rates, average deal size, and sales cycle length before implementing changes. Track metrics at each sales stage: lead-to-opportunity conversion, opportunity-to-proposal, proposal-to-close. This baseline lets you measure improvement and identify which methodology components deliver the biggest impact.

Pro tip: Document your top performers' close rates separately—their results become your team benchmark.

Analyze sales stages

Map your sales process into distinct stages, then calculate conversion rates between each one. If 100 opportunities yield 20 proposals but only 5 closed deals, your proposal-to-close stage needs work.

Look for patterns: Do deals stall during technical evaluation? Economic buyer approval? This analysis tells you which methodology components to emphasize—MEDDIC for stakeholder alignment, SPIN for discovery improvement, Challenger for differentiation.

Develop a training plan for the sales team

Build training around the specific skills your methodology requires. For example:

- MEDDIC needs qualification questioning to identify economic buyers and decision criteria

- Challenger needs confident insight delivery and reframing techniques

- SPIN needs consultative discovery and active listening

Use role-playing with real scenarios, record practice calls for feedback, and create methodology-specific scripts. Schedule ongoing coaching sessions, not just one-time training workshops.

Prepare for resistance

Expect pushback from reps who've built their own successful approaches. Here are some tips:

- Address concerns by connecting methodology benefits to individual pain points—fewer stalled deals, shorter sales cycles, better competitive positioning.

- Host open forums where reps can voice objections and ask questions.

- Involve vocal skeptics in pilot testing so they experience results before full rollout.

Early adopters who see success become your strongest advocates during team-wide implementation.

“To overcome resistance to change one needs to highlight the benefits of the new methodology. Engage with the team early on by involving them in training sessions and show how the new method will assist them in closing more deals and increase performance. A similar solution applies for inconsistent adoption: ensure that there is proper training for the team and conduct regular check-ins. Also, assign sales coaches to oversee the adoption and assist with any issues. “

Kegan Croxford, Sales Director at Mentally Fit South Africa

Define metrics for success

Choose KPIs that measure sales effectiveness:

- Qualification accuracy (percentage of qualified deals that close)

- Sales cycle length

- Win rates by stage

- Average deal size

For MEDDIC, track how often reps identify economic buyers correctly. For SPIN, measure discovery call effectiveness. For Challenger, track win rates in competitive deals. Review metrics weekly during rollout, then monthly once adoption stabilizes.

Set clear milestones

Break the implementation process into phases with specific deadlines, like:

- Complete baseline sales analysis in two weeks

- Finish initial training in six weeks

- Achieve 50% methodology adoption in three months

- Reach full adoption in six months

Celebrate completion of each phase—training graduation, first deal closed using new methodology, team hitting adoption targets. Visible progress maintains momentum.

Create collateral for your sales team

Build methodology-specific tools:

- MEDDIC qualification scorecards

- SPIN question guides organized by stage

- Challenger insight templates with industry data

- Gap Selling current-state assessment worksheets

Include real examples from your top performers and create proposal templates that align with each methodology's structure. When reps have ready-to-use materials, adoption happens faster than when they build everything from scratch.

Explore aligning sales and marketing strategies

Coordinate content creation with your methodology choice. For example:

- Challenger: Marketing develops industry insights and provocative statistics reps can teach with.

- MEDDIC: Marketing identifies economic buyers and decision criteria in target accounts

- SPIN: Marketing creates problem-focused content that feeds discovery conversations.

Schedule monthly alignment meetings to review what content reps actually use and what's missing.

Monitor and adjust based on long-term performance

Track adoption rates and performance metrics monthly for the first 90 days. Measure how consistently reps use the methodology component:

- Are they asking SPIN questions?

- Identifying MEDDIC criteria?

- Teaching with Challenger insights?

If sales reps aren’t using specific components, add focused training or simplify the framework. Collect rep feedback on what's working and what feels forced. Adjust based on results, not assumptions.

Choose your methodology, then execute it consistently

Picking a methodology is the easy part. The harder work is training your team, creating supporting materials, and tracking adoption over months. Without the right infrastructure, even the best framework falls apart.

Match your choice to deal complexity—enterprise needs MEDDIC, consultative needs SPIN, transactional needs BANT. Then build the tools that make daily execution straightforward: templates, checklists, and frameworks your reps use during sales conversations.

Qwilr's methodology-specific proposal templates help teams implement MEDDIC, SPIN, Challenger, and Gap Selling with interactive documents built around each framework's structure. Try Qwilr free or explore our sales templates.

About the author

Kiran Shahid|Content Marketing Strategist

Kiran is a content marketing strategist with over nine years of experience creating research-driven content for B2B SaaS companies like HubSpot, Sprout Social, and Zapier. Her expertise in SEO, in-depth research, and data analysis allow her to create thought leadership for topics like AI, sales, productivity, content marketing, and ecommerce. When not writing, you can find her trying new foods and booking her next travel adventure."

FAQs

A sales methodology is a structured approach that guides how salespeople approach their tasks, such as engaging prospects and closing deals. It includes specific principles, techniques, and strategies that define the way sales activities are conducted. In contrast, a sales process is the set of steps or stages that leads follow from initial contact to conversion into customers. While the process maps out the journey, the methodology shapes how the journey is executed.

- SPIN Selling: Focuses on asking questions about the customer's Situation, Problem, Implication, and Need-Payoff to uncover pain points and provide tailored solutions.

- Challenger Sale: Encourages salespeople to challenge the customer's perspective and provide unique insights that reshape their approach to solving problems.

- Solution Selling: Emphasizes understanding the customer's pain points and delivering a solution that meets those specific needs.

- MEDDIC/MEDDPICC: A qualification framework that emphasizes identifying pain points, champions, decision processes, and competition.

Each methodology is effective because it provides a systematic approach to understanding and solving customer challenges while adapting to the specific industry, customer, or market conditions.

Selecting the right sales methodology requires assessing the organization's industry, target market, and customer journey. Here are steps to guide the selection:

- Analyze Current Sales Challenges: Identify the main obstacles your team faces in closing deals, managing leads, or engaging prospects.

- Understand Customer Behavior: Consider your customers' buying patterns, decision-making processes, and common pain points.

- Match with Business Goals: Ensure the chosen methodology aligns with broader sales goals like improving conversion rates, shortening the sales cycle, or increasing deal size.

- Consider Team Strengths: Select a methodology that leverages the team's skills and can be seamlessly integrated into their existing workflow.

- Test and Refine: Implement the methodology in a pilot phase, gather feedback from the team, and refine the approach based on results.