BANT vs. MEDDIC – What’s the Best Way To Qualify Leads?

In any industry, a sales team lives and dies by its qualification framework. But, even the best marketing teams can only provide limited qualification data for the leads they generate. According to Hubspot, only 56% of B2B companies provide their sales team with marketing qualified leads (MQLs). The other 44% are leaving their salespeople to sift through leads and determine what might be viable.

There are many different qualification frameworks, each with varying degrees of complexity. In this article, we’ve chosen two very different frameworks, BANT and MEDDIC, which can help you improve your sales performance if applied under the right conditions. Both frameworks have something valuable to offer - even if you take them as a starting point that you can optimize to meet your qualification needs.

Key takeaways

- If you’re looking to make more sales, use BANT. If you’re hoping to increase your average deal value, use MEDDIC.

- MEDDIC is best suited to enterprise sales; BANT can be used to sell to small and medium businesses (SMBs).

- Some sales operations might benefit from using both frameworks in a two-stage process.

What is the BANT sales framework?

BANT is the grandfather of qualification frameworks. IBM designed it in the 1950s. So, it's remarkable that we’re still talking about BANT 70 years later—in a business and sales environment that would have been almost unimaginable to its creators.

BANT’s staying power is undoubtedly due to its simplicity. The idea of using a predetermined set of criteria to assess potential prospects was revolutionary in the 1950s. Since then, ever-more complicated and prescriptive iterations of this basic idea have made BANT seem almost fresh in its broad relevance to a wide range of sales contexts.

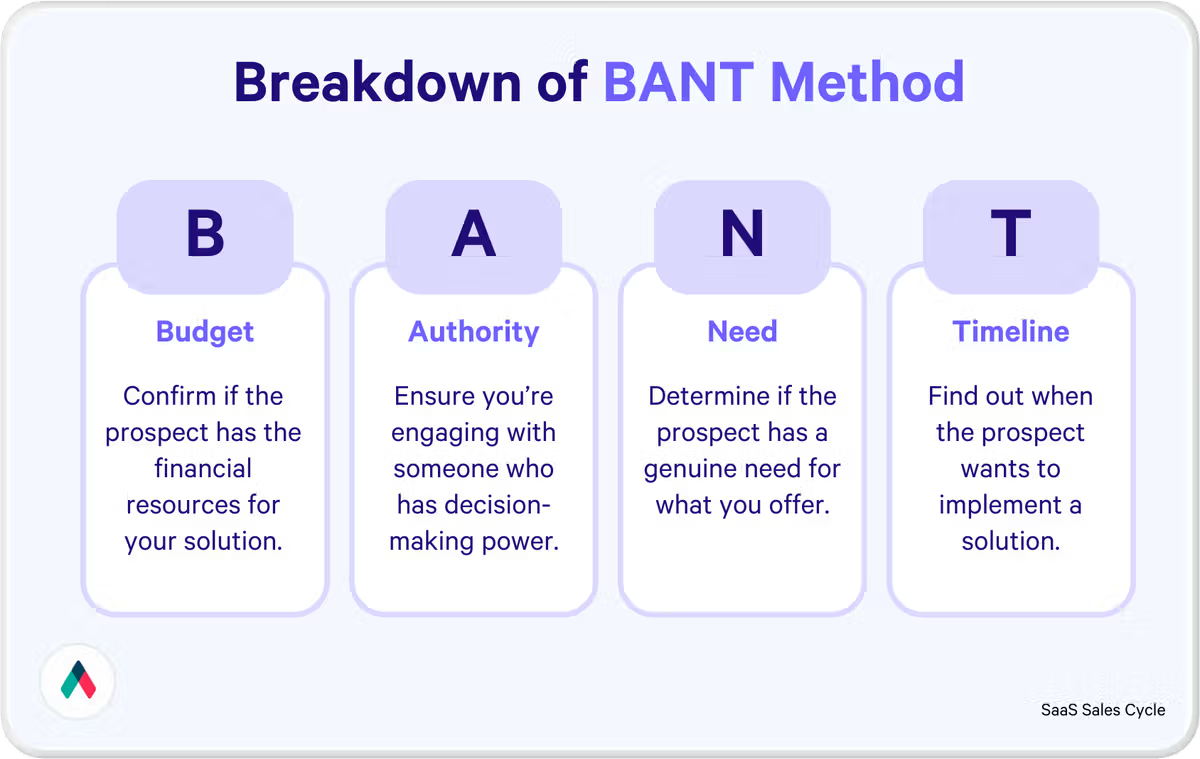

The acronym BANT stands for Budget, Authority, Need and Timeline. Each area allows sales teams to formulate inquiries that help them understand whether a sales lead should be pursued or abandoned.

Budget

Establish whether your prospect can afford the sale to lay the foundations for an honest sales conversation. If you’re in a position to explore further, understanding how your offerings fit into their broader budget will help. Will the purchase stretch them? Are they likely to need a payment schedule?

Authority

Understanding who’s making the decisions will help you prioritize your communications and address your sales strategies to the key individual or individuals concerned.

Need

When using BANT (as with many other sales strategies and techniques), communication around the client’s needs is a two-way street. In addition to finding out their most pressing pain points, you should communicate to them that you understand the specific challenges they face.

Timeline

What factors influence them to purchase now rather than in six months? What potential hurdles might delay the sale? Build an understanding of their time frame.

What is the MEDDIC sales framework?

MEDDIC was devised in the 1990s by sales professionals Jack Napoli and Dick Dunkel while working at U.S. software giant PTC.

Foreshadowing the digital revolution that was to come, MEDDIC involves the creation of a comprehensive dataset that creates a picture of the prospect’s internal environment - helping you understand the complex factors that will ultimately determine the sale.

The MEDDIC acronym stands for:

- Metrics: Or how value is measured.

- Economic Buyer: The person with the purchasing authority in your client or prospect’s organization.

- Decision Criteria: The benchmarks, features, or other criteria used to make a purchase decision.

- Decision Process: The process the organization goes through to make the decision. This could be how (and when) a prospect will evaluate a product or service.

- Identify Pain: What pain point is the prospect looking to address with your solution?

- Champion: The person (or group of people) internally advocating for you and your product or service.

How to decide between BANT vs. MEDDIC sales frameworks

As you can see, these two frameworks offer two distinctly different approaches. They’re both suited to different situations.

To figure out which methodology is relevant to your sales organization, it’s useful to think about the issues you’re trying to solve, by asking yourself the following questions.

Do I have too many unqualified leads?

If your SDRs are facing a backlog of unqualified leads, a time-intensive framework like MEDDIC will not solve your problem. The simpler, faster processes of BANT will be more useful.

Am I consistently losing prospects and sales after they’ve been qualified?

If so, there may be friction in the sales process that you’re unaware of. There could be a few different explanations for this, but a deeper exploration at the qualification stage - using MEDDIC - will likely provide at least some of the answers.

Do I need to increase the volume or the value of our sales?

If you’re looking to streamline your sales processes, increase sales velocity, and close more deals, BANT is a good place to start.

If you’re hoping to concentrate your sales efforts on your brightest prospects, increase customer lifetime value (CLV), and reduce churn, MEDDIC will help you narrow down to the audience you need.

Read next: Incremental sales best practices

Use case #1: Auditing services

Audit providers are no strangers to longer sales cycles - invitations to tender are commonly sent more than 18 months ahead of schedule to a small and carefully curated list of auditors.

Even before those requests for proposals are sent, many publicly traded companies will announce their intention to audit to help manage any potential impact on share price over a longer period.

Consequently, sales teams for audit companies can concentrate their qualification efforts on prospects who are openly ready to buy. Enterprises procuring these sensitive and essential services will usually rely on a buying team that represents the interests of a range of different departments and interested parties within the organization.

🏆 Verdict: MEDDIC

These high-value deals and epic sales cycles perfectly align with MEDDIC’s thorough, data-driven methods. With large, complicated buying teams that may have differing priorities and agendas, your qualification framework needs to provide as much information as possible about how decisions are made - and by whom.

Use case #2: EPoS till systems for independent retailers and small businesses

Owners of proprietary EPoS till systems need to upgrade and maintain the infrastructure - software, storage, etc. - that their systems are built around. The cost per installation of this maintenance work goes down as they add more customers, so volume of sales (and hopefully, widespread adoption) is essential to EPoS businesses.

With over 31 million small businesses registered in the U.S. alone, EPoS companies often have many potential leads to qualify.

🏆 Verdict: BANT.

With lead generation potential that can easily outstrip the capacity of the SDR team, a streamlined qualification process will help EPoS vendors identify a greater number of qualified leads in a shorter period of time.

As most small retail businesses won’t have a buying team or an involved decision-making process, MEDDIC is of no use under these circumstances.

Use case #3: Financial services

Financial advisors work with a broad spectrum of clients, ranging from wealthy entrepreneurs to large corporations. They provide specialized services such as risk management or investment solutions, as well as advice that changes significantly according to constantly evolving market conditions.

Due to the breadth and variety of the market for financial services, clients might not necessarily need or use a large buying team.

🏆 Verdict: Neither

A trusted advisor is expected to provide a level of expertise that the client simply can’t provide for themselves. A consultative selling approach is key here to help ascertain the client’s most pressing needs across various financial contexts. A BANT approach would potentially rush the process, failing to account for the complexity of the client’s needs.

Conversely, the variety in client size and organizational structure would leave MEDDIC-style sales teams struggling to find consistency in their approach to help them develop a solid, repeatable process.

Use case #4: Virtual sales tools

SaaS companies often deploy a tiered pricing structure, with a high-value ‘Enterprise’ tier where the tool can be reconfigured in line with the customer’s needs. The same tool is often available in a vastly simplified and limited form at the other end of the pricing tier. This low-cost, ‘freemium’ or free tier is primarily designed to increase adoption and sales volume.

🏆 Verdict: both.

A light-touch, BANT-style qualification process can be applied initially to ascertain whether leads are a realistic prospect for the ‘Enterprise’ tier. Once leads have been qualified, a more rigorous, MEDDIC framework can be applied to help close the deal.

In some circumstances, the BANT qualification process can be semi-automated (typified by the approaches used to qualify business owners for Linked In Sales Navigator and other tools).

Pros and cons of MEDDIC and BANT

Pros of MEDDIC

1. Ideally suited for enterprise sales

According to Gartner, the average tech purchase involves between 14-23 people, most of whom are in senior operations or product roles.

In a complex sales environment, understanding how the decisions are made (and who is likely to champion your product) isn’t just a good idea; it’s table stakes for any SDR team.

2. A better understanding of the buyer

Using a comprehensive set of MEDDIC questions to investigate your client’s buying team, decision makers and buying processes can provide a knowledge base that informs and strengthens the whole relationship - providing benefits at every stage of the customer journey.

The depth of information gathered also makes it easier to reflect and improve on your qualification processes, by identifying and investigating occasions where deals have been lost despite rigorous lead qualification.

Cons of MEDDIC

1. This only really applies to enterprise sales and long sales cycles

MEDDIC focuses on identifying different actors and decision-makers within the prospective buying team, with intensive questioning designed to draw out additional information about the decision-making process.

Without these larger buying teams and decision-making processes, MEDDIC’s usefulness dwindles. It’s only relevant when selling to large organizations and enterprises.

2. Resource-heavy

To make MEDDIC work, you’ll need to sustain a prolonged commitment to sales excellence. You’ll need specific resources in place, including a well-maintained customer relationship management (CRM) system to capture and store the data appropriately.

You’ll also need to invest in sales enablement, to ensure your SDRs have the time and the training to accommodate the extra workload involved in implementing MEDDIC consistently across the sales team. Data associated with these sales enablement strategies will also need to be tracked and measured.

Pros of BANT

1. Fast and simple

The secret of BANT’s longevity is its simplicity. It’s straightforward enough for reps to easily absorb and implement its four simple tenets, and flexible enough to accommodate additional requirements and conditions specific to an industry, market or product.

Many different kinds of sales environments will suit a BANT-based framework - even transactional sales models with short sales cycles.

2. Prioritizes sales-ready leads

By emphasizing budget and timeline, BANT allows reps and SDRs to make the most of an abundance of leads by quickly identifying prospects who are ready to buy, increasing sale volume and velocity and driving up your win rates.

Cons of BANT

1. Too seller-centric

The speed advantages offered by BANT don’t apply in complex selling environments, where BANT’s simplicity might not provide enough data for a robust sales process. The lack of focus on the buyer and the absence of a thorough investigative approach means that the buyer (and seller) may not be aware of how your product or service could solve their issues.

This can lead to solid prospects being disqualified prematurely.

2. Assumptions about accessibility to decision-makers and budget information

Even small business owners aren’t always forthcoming with information about their budgets.

The buyer might not wish or be able to provide a straight answer to your budget inquiries. And if you can’t access the ‘Authority’ - i.e. the decision maker who will approve the sale, then BANT won’t help you assess whether this prospect merits further consideration.

Here's a summary table of the pros and cons of each methodology:

| BANT | MEDDIC | |

|---|---|---|

Pros | ✅ Fast and simple | ✅ Ideal for enterprise sales |

✅ Prioritizes sales-ready leads | ✅ In-depth buyer understanding and improved qualification | |

Cons | ❌ Too seller-centric | ❌ Suited mainly for large organizations |

❌ Assumes accessibility to decision-makers and budget info | ❌ Resource-heavy |

You can’t set it and forget it

While BANT might not offer the perfect all-in-one qualification solution for modern sales environments, it’s important to remember that the same criticism can be aimed at almost any framework or methodology - including MEDDIC. The secret lies in adapting BANT (or any other sales approach) to the conditions of your sales environment.

No matter how comprehensive or flexible a selling system might appear, they work best when treated as a starting point for your own tailored methodology and strategies.

That’s why Qwilr’s set of proposal templates are instantly customizable, allowing you to mix, match, and tweak strategies from different sales approaches and create a playbook that perfectly meets the needs of your organization - and your buyers.

Try Qwilr free for 14 days, and you’ll see for yourself.

About the author

Dan Lever|Brand Consultant and Copywriter

Dan Lever is an experienced brand consultant and copywriter. He brings over 7 years experience in marketing and sales development, across a range of industries including B2B SaaS, third sector and higher education.

Frequently asked questions

In addition to BANT-adjacent frameworks such as FAINT or ANUM, there is a range of more involved qualification frameworks, such as MEDDIC, CHAMP, or GCPTBA/C&I. These are more buyer-focused and suitable for consultative selling approaches.

Strictly speaking, BANT is a sales qualification framework, not a methodology. It’s most useful as a guide to help sales reps quickly disqualify unsuitable leads.

Although some IT and software companies may use BANT in combination with more involved qualification frameworks, the idea of a single decision-maker with the ‘Authority’ doesn’t mirror most organizational structures in the IT industry.