Achieving success in sales goes beyond just securing quick wins; it’s about crafting a sales strategy that grows and adapts with your customers, market, and products. Enter MEDDIC—a highly esteemed sales methodology that provides a solid framework for qualifying new business and advancing opportunities towards closed won revenue.

This strategic approach empowers reps to deeply connect with prospects, accurately meet their needs, and guide them seamlessly through the decision-making process.

When it comes to implementing MEDDIC in your sales process, you have a lot of room to adapt and interpret the framework, making it work for your sales style, your product, and, most importantly, your customer.

We’re here to help you understand exactly what MEDDIC sales is, how to implement it, and what questions to ask.

Key takeaways

- MEDDIC is a flexible sales framework that can be adapted to suit your sales style, product, and customer.

- Asking the right questions during the sales process can uncover crucial information about the metrics, economic buyer, decision process and criteria, and your champion.

- Understanding the economic buyer's needs and personal preferences can be a game-changer in winning the deal.

- Identifying your prospect's pain points and understanding how they impact the organization can help craft a stronger proposal.

- A true champion is invested in the success of the deal and can provide valuable insights about the perceptions of the buying committee.

What is the MEDDIC sales methodology?

Calling MEDDIC a sales methodology is a bit of a misnomer. It’s really the framework or sales qualification methodology used to qualify opportunities and, generally speaking, can help drive the early stages of an organization’s sales cycle.

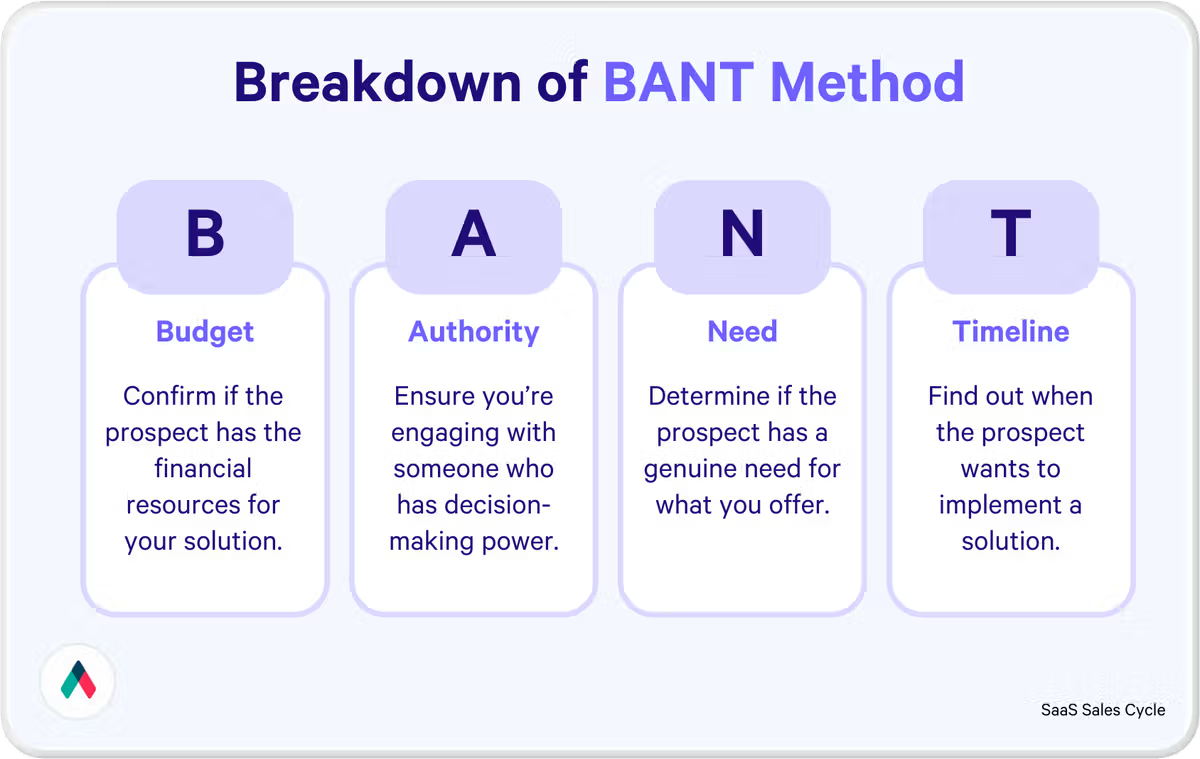

MEDDIC is an acronym that stands for:

- Metrics: How do you measure the value you bring to your clients?

- Economic Buyer: Who is the person with the purchasing authority in your client or prospect’s organization?

- Decision Criteria: What are the benchmarks, features, or other criteria used to make a purchase decision?

- Decision Process: What process does the organization go through to make the decision? How (and when) will a prospect evaluate a product or service?

- Identify Pain: What is the pain point that the prospect is looking to address with your solution?

- Champion: Who is the person (or group of people) internally advocating for you and your product or service?

The MEDDIC sales method has sellers go through each step and uncover critical information about the deal. This methodology was developed back in the early 1990s by Jack Napoli and Dick Dunkel when they were working at PTC. They were able to use this framework to take their sales annual sales from $300 million to $1 Billion in four years– which was a huge economic benefit to PTC.

Why is qualification so important?

Qualifying an opportunity using a framework like MEDDIC can help sales teams save time and focus on the deals that are most likely to move forward. By following the MEDDIC framework and gathering all of the necessary information, sales reps can identify and prioritize the deals that are most promising.

Imagine you’re mid-qualification and uncover that a key decision-maker at your prospect's company has a strong preference for a competitor's product and has personal connections there. Without MEDDIC, this might have been realized only after investing significant time in calls and presentations. However, MEDDIC saves you these precious hours by guiding you to disqualify such low-potential opportunities early on.

On the other hand, consider a scenario where during the qualification process, you learn that your prospect is actively searching for a solution, has a substantial budget allocated, and a key stakeholder has previous positive experiences with your product. The MEDDIC framework helps you recognize this as a high-potential deal, prompting you to invest your efforts wisely.

How to implement MEDDIC in your organization

If you’re looking to implement MEDDIC into your organization, you need to ensure everyone is onboard and speaking the same language. Samantha Lancashire, the Chief Everything Officer of Creating Lightbulb Moments, a sales enablement consultancy, emphasizes this point when thinking about getting started. She says,

“Get the whole of the GTM, including teams that support sales and pre-sales, to utilize the framework - having a common language is very beneficial when hand-offs are required between teams and departments that play a role in completing a sale.”

And when she talks about the whole team, she also means the organization’s senior leadership. She says,

“Ensure senior leadership team members are also MEDDICC ambassadors in their messaging, communications, and expectations. This increases visibility and adoption.”

Before you can implement MEDDIC, you need to teach your sales reps how to find and address each factor that makes up the acronym.

Metrics

The metrics that a potential buyer uses to quantify the value of your solution can vary from organization to organization. According to the MEDDICC organization, there is one rookie mistake many sellers make when aligning their Metrics to the value proposition of their solution. They say that sellers think, “Everyone knows my solution is most commonly used for driving increases in conversion rate, so a Metric for my customer must be increased conversion rate.”

By going deep in the discovery process, sellers can understand the fullest extent of the organizations’ pain points and the value their solution can actually bring. While, in the example above, an increased conversion rate may be of value to a prospect, the real value in the solution may be that their customer success team can focus on higher-value activities and help more customers grow in their use of the solution.

Economic Buyers

Like Miller Heiman Strategic Selling (Blue Sheet) the economic buyer is the person in an organization with the overall authority in the purchase decision. How does a sales rep know if they’ve found the economic buyer? The person can say no to the deal when everyone else on the buying team says yes. They can also say yes to the deal when anyone (or everyone) else says no.

- If you need a few other ways to tell you’re dealing with an economic buyer, find out if the person:

- Has P&L responsibility for the organization or their functional area

- Has access to unrestricted funding or discretionary budget

- Is the person who will ultimately sign the contract when the deal closes

Decision criteria

In some cases, like when responding to an RFP (Request for Proposal) or formal bid request, as is common in larger companies when making big purchases, decision criteria may be clearly spelled out for the sales rep or sales team. But, if you’re doing proactive outreach, you might have to do some detective work to understand your prospect’s decision-making process.

Even when the prospect’s needs seem obvious, and the salesperson has created a solution to address them, it’s still important to understand all of the elements of the decision criteria. This could include the return on investment, pricing, contract terms, or even how the solution will be rolled out in the customer’s organization. Not understanding if these elements are part of the decision criteria can result in the prospect’s final decision going to another solution.

Decision process

Once the sales team or salesperson knows how the deal will be measured, it’s important to understand the decision-making process and any approval process the buying team will follow. When learning about the decision process, salespeople should seek to understand the time frame for making a decision, who will be involved (decision makers), and how they will conduct their evaluation.

If the buying decision is a big one, there may be a lot of people involved in the decision process, which can lead to a longer sales cycle. If the salesperson learns this is the case, they should plan appropriate and regular follow-up during the decision-making timeframe as part of their sales strategy.

Identify pain

As part of the lead qualification process, salespeople need to identify pain (or validate it). Selling a solution to a problem that a prospect doesn’t have generally won’t result in a closed deal.

MEDDIC today talks about three main kinds of pain. They are:

- Financial Pain

- Efficiency Pain

- People Pain

Champion

The champion is someone in the customer’s organization who is internally selling or strongly advocating for you and your solution. While this person might be obvious, as in they’re the one that contacted you in the first place or they’re vocally supportive in meetings, there are some other ways to find out if you have a champion or if your champion has enough power and influence in their organization to help you move the deal forwards.

Continual learning & getting MEDDIC to stick

The reason we always hear the expression, practice makes perfect is because it’s true. As with any new (or new to you) methodology, it takes practice to feel comfortable and get good at using it. MEDDIC is no different. And not only do sellers need to practice, but sales leaders and other executives in the organization need to as well to ensure everyone is using the framework.

Sales training, in general, is not a one-and-done but something that should be prioritized over the course of the fiscal year. While some classroom training or even certification can be extremely beneficial, don’t underestimate the day-to-day opportunities for on-the-job learning.

Ken Millard, an Experienced Enablement Professional and member of the Sales Enablement Collective, says,

“MEDICC must become the language and context of the deal.”

He further explains that you should not expect sellers or sales managers to fully adopt the methodology without support from sales enablement (if your organization has this function).

In his work rolling out MEDDIC, he uses the three Ps — Push, publicize, and pander. Push the teams to adopt, publicize early adopters and early successes, and pander to those laggards (a little). This way, they will start to come around when there is momentum.

Essential MEDDIC questions you should be asking

Metrics

1. What steps are you currently taking to measure progress toward your goals?

This question helps you understand how a prospect thinks about their goals and how they measure progress. When digging in here, a sales rep can learn more about how the organization sets goals and KPIs they use to measure success. You want to hear that they think about SMART (specific, measurable, achievable, reasonable, and time-bound) goals with defined metrics that everyone understands.

2. How do you define success? Do you think it's the same or different than others in your department or business unit?

This question should come up very early in your MEDDIC sales process. As part of your sales qualification, the earlier you uncover how your prospects and others around them, like their boss and key stakeholders in the business, define success and what might be unique about their definition relative to other roles, the more time you will have to put together a compelling case for moving forward with your solution. This is especially critical in enterprise sales, where committees make deals.

3. In your intake form (or other form of discovery), you defined X as your biggest pain point. What have you done to address it previously, and how much of your budget have you allocated to alleviate this pain point? What are you willing to spend to find a solution?

Posing this question by starting with something the prospect has already shared shows that you've paid attention to detail and actively listened when they've shared information. Now, you're looking to draw out new insights to help you better craft your proposal (when the time comes). Using this question in your lead qualification process can help ensure your prospect's need matches your solution.

4. What does a successful outcome in this area look like to you?

With this question, you're getting a little personal. You're seeking to understand what success looks like to your prospect and your prospect alone. This will help you understand how you help them win. For example, is implementing new financial software on time and within the budget what they need to get promoted from AVP to Vice President?

5. What tools do you use to collect and analyze data?

This question is especially important if you're selling a SaaS tool. That said, it applies broadly, as you want to know how the organization is collecting and analyzing data. Is their process clear and easy to understand? Will your solution tie nicely into their current process and provide additional data or context? If so, make sure that when you write a proposal, you address this information.

Economic Buyer

6. Who signs the contract should we move forward with this deal?

This question must be asked as part of the MEDDIC sales qualification process. Sales professionals never want to waste their time on a deal, knowing that they can't (or didn't) engage with the economic buyer. Therefore, getting clear on who this individual is as early in the process as possible can be a huge time saver. It ensures that you're talking to the right potential customer.

7. Can I meet with the final signer as part of this process?

Similar to the question above, getting this information quickly is part of the reason sellers use this method. To save time and energy. If the answer is no, it might be a big red flag that the deal won't close or that the prospect is just shopping around. An enthusiastic yes in response to this question is a green flag and a sign that your prospective customer is serious about potentially moving the deal forward.

8. What does your final signer need to see in order to sign a deal confidently?

Getting clear on this might be part of the decision criteria, but it's really important to ask it directly. You may learn that there is something important to this stakeholder that hasn't been communicated through the official decision criteria. Understanding what will allow them to move forward can be the difference between winning and losing the business. Even if everyone else says yes to you, the deal can still fall through if the economic buyer is not bought in.

9. Is there anything else I need to know about your economic buyer?

When it comes to winning your deal, understanding the economic buyer is a superpower. In addition to what you learn about the person's needs, try to get information about them personally. Maybe they go by Matthew and hate being called Matt. Or, maybe she's not a morning person and likes meetings around 3 p.m. Any insights into the economic buyer's likes and dislikes can help smooth out the details and position you as the best person for the job.

Decision Criteria

10. Is there a formal set of decision criteria?

Whether you follow MEDDIC, MEDDPICC, or something else, asking this question should be part of your sales process checklist to ensure nothing is missed. If you work in a business that responds to potential customers' formal RFPs, these criteria should be clearly outlined in that document. If not, ensuring you know all the business decision criteria before submitting your proposal should be a priority. No one wants to lose a deal because they missed a key document or a step in the process.

Read next: MEDDIC vs MEDDPICC

11. How were the criteria set?

Regardless of whether the criteria set was formal or informally decided by the buyer or buying committee, as a seller, you want to get to the why behind the criteria. For example, if you assume that your client is looking to replace their POS system because their previous vendor was too expensive, you might misalign the solution you propose with their true need. They really set the requirements for the new system to better address security concerns and modernize an aging system...

12. Who will evaluate how well we meet the decision criteria?

Once you understand how the decision will be made and what the buyer or team is looking for in a solution, you want to know who will be evaluating your solution. This is where buyer personas can come in handy. Think about what the different personas you (or you sales enablement team) have created and their priorities. This will give you a good starting point to craft your solution and tailor messaging to the appropriate evaluators.

13. Can you share the full decision criteria?

If you're not participating in a full RFP process, it can be a good idea to confirm with your prospect (especially if you have a champion) that they have shared with you their full decision making criteria. This way, you can ensure you hit all the key points and overcome any potential objections earlier in the process.

Decision Process

14. What are the steps in the decision process?

Understanding the decision criteria is only part of the MEDDIC sales process; sellers should also understand the decision process. So once you know what the criteria are, you want to understand how the decision will be made. Will all of the RFP responses be added to a spreadsheet and analyzed? Will a field of ten prospective vendors be narrowed down to three for a final in-person presentation in New York City? Is there anything in the process that would eliminate you as a possibility? Knowing this upfront could save a lot of time and effort.

15. When will the process start, and when will it conclude?

This question starts to get at the timing of the process. While sellers may be aware of the proposal deadline, it is also good to confirm the full decision process timeline. For example, if you know the process will take 8-12 months before a final decision is made (while this feels long, for some complex deals, it's actually spot on), it can make your forecasting and any needed staffing plans more realistic. If this is a big account for your team and you know you'll need to hire, should you win the deal, you will know when to start posting jobs potentially or when you might be able to kick off the engagement after it's been awarded.

16. Can we communicate with you or anyone on the buying committee during the process?

This question can also help clarify the process. In some very formal RFP processes, the buying committee members are not able to speak to potential vendors for fear of perceived biases. This is more likely to be true when bidding on large municipal contracts and less likely when selling to a small but growing Series A startup. That said, understanding how much access you'll have to your champion and others on the committee during the sales process is always a good idea.

17. If we are selected to provide our solution when will we be notified and when do you anticipate wanting to kick off services with us?

This question is a more specific piece of understanding the process. It helps sellers and the broader organization understand what happens when the process concludes, especially if they win. In this economy, ghosting is becoming more and more common, and it's not unheard of for companies to stop responding to reps completely. Asking this question and confirming that you expect some kind of response at the end of a process is never a bad idea.

Identify Pain

18. Are you able to share how you came to this pain point?

When identifying your prospect's pain points, understanding how they got to that point and not just what the pain point is, can help sellers have deeper, more impactful conversations about the proposed solution. For example, a sales rep looking to bring a new web-based time tracking tool into a growing startup may come to understand that manual payroll and time entry have gotten more cumbersome now that the company is at 15 locations in 7 states. This is also good information for the rep to have when it comes to upselling if they have some additional related products that could also benefit this organization.

19. Are there other solutions you have tried previously or are considering trying now?

Understanding what the prospect has tried and why it hasn't worked can help a seller craft a stronger, more compelling proposal. For example, if you're pitching that time-tracking software, and you know your prospect has tried a competitor, find out the whole story. Maybe it didn't work because they had a poor onboarding experience, and the customer support was lacking -- all areas where your platform shines. Addressing that in your proposal (when you get to it) will likely resonate with your prospect more strongly.

20. How does this issue impact the organization outside your department or business unit?

This question can help illuminate the bigger picture, even if you initially only talk to one person. Having your prospect explain how the pain point identified is impacting other departments or team members can help you make more connections to your solution. If you can talk to more people to get the full picture, that's even better!

21. Who is supporting this possible change?

Understanding where the support lies will help you craft a more compelling argument for your solution to their business pain. It can also give clues that the organization is not ready to buy. For example, if the support is not at the right level to take action or secure the needed budget, it might be best to limit how much effort goes into this deal.

Champion

22. Can you get me (some information or access to help me win the deal)?

This question is meant to be a bit of a test to help see if you're dealing with a true champion and someone who is invested in the success of the deal. If you have found your champion, this person should be willing and able to help you access the information and decision-makers you will need to close the deal well.

23. What can you share about the perceptions of the people on the buying committee?

If you're really dealing with a champion, the answers to this question should give you a real behind-the-scenes look at the perceptions of others on the buying committee and how they think and feel. If you're being fed politically correct fluff or platitudes here, it's likely this person isn't really your champion.

24. Is there anything else I should know before I submit my proposal?

Again, the devil is in the details. You might even have a chance to review your proposal with your champion before officially submitting it to the buying committee. If this is an option, take it - along with any final coaching or pointers your coach can give you.

25. Is there anything else you're concerned about in this process?

Finally, this question is the opportunity to get ahead of any objections you might need to overcome. Asking your coach what concerns they have about the process and, ultimately, the outcome before submitting your proposal or best and final numbers can help you be proactive and provide what your prospect needs to enthusiastically say yes!

Meddic sales framework template

Strengthen your sales approach with our interactive MEDDIC Sales Template. This user-friendly template helps sales reps navigate the MEDDIC methodology, focusing on metrics, economic buyers, decision criteria, and more. Equip your team with the tools to identify high-potential opportunities and close deals more effectively.

Determining if MEDDIC is right for your organization

The MEDDIC sales methodology was designed to guide sellers through the lead qualification process. To use the MEDDIC sales process correctly, sellers must ask great questions to understand the situation and how to craft an appropriate solution.

In organizations with sales enablement teams, MEDDIC should be supported with related sales training, playbooks, and even proposal templates that help sellers through the process. This will ensure that sellers are using the framework consistently and correctly. For sales proposals or collateral templates, Qwilr has sales enablement and sales teams covered. Book a demo today if you want to learn more or see our capabilities in action.

About the author

Marissa Taffer|Founder & President of M. Taffer Consulting

Marissa Taffer is the Founder & President of M. Taffer Consulting. She brings over 15 years of sales and marketing experience across various industries to a broad range of clients.

Frequently asked questions

MEDDIC is a sales process framework that guides you through the sales process. It allows for flexibility to adapt and interpret the framework to suit your sales style, product, and customer.

Important questions include understanding the prospect's goals, their definition of success, their biggest pain point, their vision of a successful outcome, and the tools they use for data collection and analysis.

The economic buyer is the individual who signs the contract. It's crucial to identify and engage with this person early in the sales process.

Understanding the decision criteria is vital as it helps you know what the buyer or team is looking for in a solution. It also helps in crafting your solution and tailoring messaging to the appropriate evaluators.

A champion is someone who is invested in the success of the deal. They can provide access to necessary information and decision-makers, share insights about the buying committee, and help overcome any objections.