You know how in every romantic comedy there’s that early stage where sparks fly, glances linger, and someone says something charming about the way you butter toast? That’s the quote. Then… fast forward past the montage… there’s the moment when two people decide to put it all in writing, sign the papers, and legally bind themselves to one another? That’s the invoice.

Quotes and invoices are the rom-com of the business world. They’re not the same, they don’t happen at the same time, and if you confuse them, you might end up ghosted by your prospect (or worse, sued).

So, let’s unpack the difference between quotes and invoices with the kind of clarity you deserve.

Key takeaways

- Quotes = First impression; Invoices = Commitment - Quotes are your way of piquing interest and outlining what’s on offer. Invoices are the official request for payment once the deal is agreed.

- Clarity is king - Clear quotes and invoices prevent confusion and disputes. They also protect you from scope creep and ensure everyone knows what’s expected.

- Qwilr makes it seamless - Interactive quotes, e-signatures, and integrated payments streamline the whole process. Prospects can move from interest to payment without unnecessary back-and-forth.

- Templates save time - Using Qwilr’s pre-built quote and invoice templates keeps your documents consistent and professional. They also speed up creation and give visibility into what works best.

The quote

Quotes are your “Hey, you’re cute, want to grab dinner?” moment. They’re not binding, not final, and certainly not the place to demand money. A quote is essentially an invitation to do business, showing your potential client what you can deliver and how much it’ll cost.

Why quotes matter (More than you think)

A good quote:

- Shows professionalism: It proves you’re not making up prices on the spot.

- Builds trust: Clients like knowing what to expect. Ambiguity = red flags.

- Protects you from scope creep: When a client asks for “just one more thing,” you’ve got a written reference for what was agreed upon.

Imagine asking someone out to dinner and never mentioning where, when, or who’s paying. That’s what it feels like when businesses skip quoting and go straight to invoicing.

What goes into a quote?

Think of a quote as the dinner menu you hand across the table. If it’s clear, tempting, and well-designed, your chances of a “yes” skyrocket.

A solid quote includes:

- Your business details: Legal name, address, contact information, and business registration or tax numbers if applicable.

- Client details: The customer’s name, company name, address, and contact information.

- Description of goods/services: A clear outline of what you are offering, including quantities, specifications, or scope of work.

- Estimated costs: Itemized pricing for each product or service, plus a subtotal, taxes (if relevant), and a total estimated cost.

- Terms & conditions: Important details such as payment terms, delivery timelines, warranties, or limitations of service.

- Validity period: The timeframe during which the quote is valid (e.g., 30 days). After this, prices or terms may change.

The invoice

If a quote is the candlelit dinner, an invoice is the marriage certificate. It’s formal, enforceable, and signals commitment. You’re no longer saying “this could be” - you’re saying “this happened, and now you owe me money.”

Why invoices matter

Invoices aren’t optional. They’re the lifeblood of your cash flow. Without invoices, you’re basically just giving away free dinners (and no one can afford that). They also:

- Serve as legal proof of work delivered.

- Help you track revenue and prepare for tax season.

- Signal professionalism. A sloppy invoice is like showing up to your wedding in pajamas.

What goes into an invoice?

Invoices have less “suggestion” and more “serious commitment.” They typically include:

- Business details: Your company’s legal name, address, contact information, and registration or tax numbers.

- Client details: The customer’s name, company name, address, and contact information.

- Invoice number: A unique reference number for recordkeeping and tracking.

- Description of goods/services: A clear list of the products delivered or services completed.

- Exact amount owed: Itemized costs, subtotal, applicable taxes, and the total amount due.

- Payment terms: Details on when payment is due (e.g., Net 30) and the methods you accept (bank transfer, credit card, etc.).

- Tax details: Any required tax information, such as VAT, GST, or sales tax registration numbers, depending on your jurisdiction.

Read next: Proposal versus invoice: Can you combine them?

Invoice vs quote: The side-by-side

| Feature | Quote | Invoice |

|---|---|---|

Purpose | Proposal of cost, not binding | Request for payment, legally binding |

Timing | Before work is done | After work is done / agreement is finalized |

Flexibility | Negotiable | Non-negotiable (unless you like conflict) |

Tone | Suggestive, open to conversation | Formal and authoritative |

Client's Role | Decides whether to proceed | Pays the bill |

Common missteps: Where businesses can go wrong

Businesses often stumble when handling quotes and invoices. Here are a few common mistakes:

- Sending an invoice before a quote.

- Failing to turn a quote into an invoice. Some businesses quote beautifully but never follow through.

- Mixing the two into one ugly document. “Quoice”? “Invo-te”? No. Keep them separate. You don’t want to confuse your prospect about what stage of the relationship you’re in.

- Overcomplicating both. Nobody likes a 20-page quote or a cryptic invoice. Keep it clear, simple, and professional.

How Qwilr helps you go from impression to commitment

You don’t need a dozen different tools to get from “I’m interested” to “we’re officially together.” You just need one that smooths the path, sprinkles in some sparkle, and keeps the whole experience delightful.

Qwilr quotes

Most quotes look like they were slapped together during a coffee break. Clunky Word docs, stale PDFs, walls of text. They’re difficult to navigate and understand.

Qwilr takes quotes to a whole new level. Instead of sending your prospect a static, PDF, or Excel document, you send them an interactive, web-based experience. Think less “takeout menu,” more “Michelin-star tasting experience.” With Qwilr, you can:

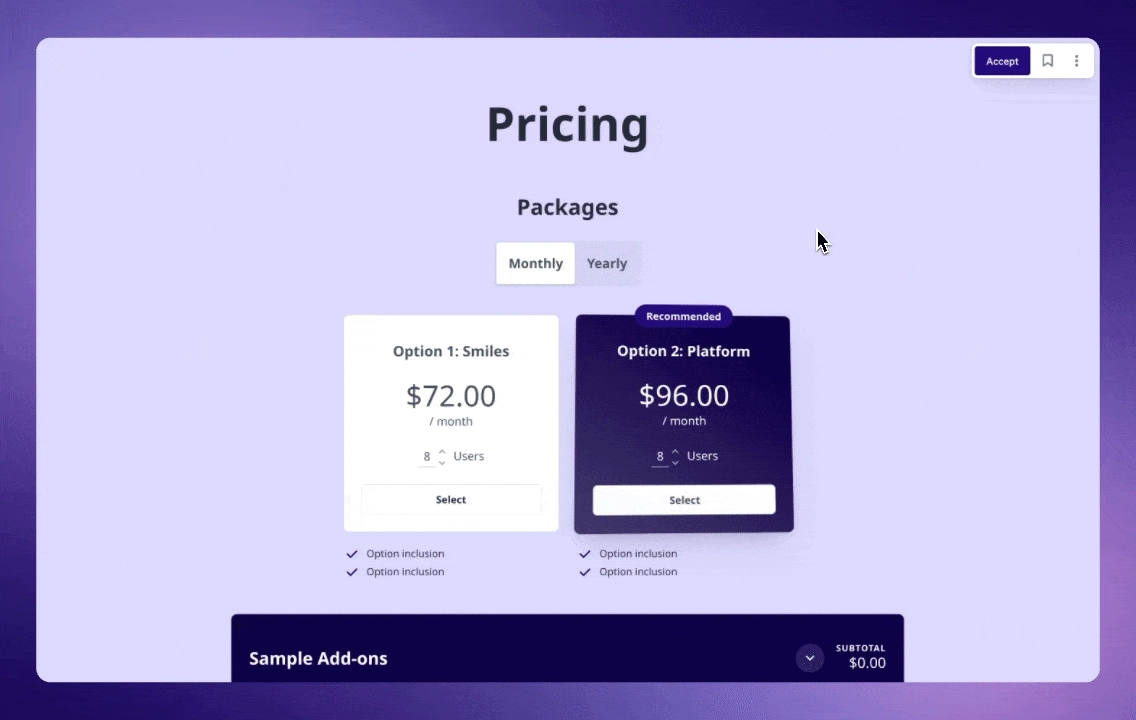

- Use interactive pricing tables: Let prospects toggle between package options, add-ons, or service tiers while the total price updates in real time. No tricky back-and-forth emails required.

- Include a formal agreement: Send a plain-text, legal agreement alongside your quote to formalise the deal.

- Enable e-signatures: Clients can accept on the spot, turning “maybe” into “yes” without delay.

Your quote isn’t just information; it’s an experience that woos your client into saying, “This feels right.” By providing transparency and giving your prospects control over pricing, you’re one step closer to a closed-won.

“We’ve never had someone say ‘wow’ about a quote – until Qwilr. Now we hear it all the time.”

Alex Dutton, Sales Director, Brisant Secure

Qwilr invoices

Now, here’s the truth bomb: Qwilr isn’t an accounting platform. It won’t balance your books or chase your customer for payment. But it does know how to keep the connection alive between your CRM and your finance tools.

Qwilr integrates with accounting heavyweights like QuickBooks and Stripe, allowing you to automate the quoting and invoicing process—removing the manual work and ensuring accurate data.

You can also use Qwilr’s native payment feature, QwilrPay, and collect payment directly from your proposal or quote document. Customers will then be sent a Stripe-powered invoice.

Instead of waiting for your quote to become an invoice and then for your invoice to (hopefully) become cash, Qwilr lets you close the loop instantly. Your client sees the proposal, loves it, clicks “Accept,” and pays right there.

"Sending a Qwilr page that contains a quote alongside all the relevant context allows us to communicate our offering more effectively and sell when we’re not in the room.”

Alex Dutton, Sales Director, Brisant Secure

Qwilr’s quote template

Qwilr’s Quote Template is designed to help businesses present pricing and scope in a polished, professional format. The template comes with clearly defined sections, each serving a purpose:

- Cover page with branding: Puts your logo, colors, and company identity front and center.

- Project overview: Outlines the problem you’re solving and the value you bring.

- Scope of work: Details the services or deliverables the client will receive, reducing ambiguity.

- Pricing table: Interactive, allowing you to present costs, optional add-ons, and tiered packages.

- Timeline: A breakdown of when key milestones will be delivered.

- Terms & conditions: Clear boundaries around payment terms, responsibilities, and limitations.

- E-signature section: Clients can review, accept, and sign the quote instantly without extra tools.

- Contact details: Ensures prospects know who to reach out to if they have questions.

Streamlined processes

Quotes and invoices aren’t enemies; they’re stages of the same love story. One sets the stage with promise and possibility, the other seals the deal with commitment and accountability.

If you want to make sure your quotes charm and your invoices get paid, Qwilr is here. Sign up for a free trial and streamline your processes

About the author

Brendan Connaughton|Head of Growth Marketing

Brendan heads up growth marketing and demand generation at Qwilr, overseeing performance marketing, SEO, and lifecycle initiatives. Brendan has been instrumental in developing go-to-market functions for a number of high-growth startups and challenger brands.