Sales proposals are having a moment. Once the final flourish at the end of a sales process, they’ve evolved into high-stakes assets, central to buyer decisions, brand perception, and deal velocity.

But as sales teams double down on proposal tooling and templates, a more pressing question has emerged: What actually makes a proposal effective? And how can you benchmark that performance meaningfully?

Let’s move beyond the standard playbook to unpack the realities of proposal benchmarking in 2025. Drawing on insights from sales and RevOps leaders across industries, we explore what works, what stalls, and what’s still overlooked when it comes to measuring and improving proposals.

Key takeaways:

- Proposal benchmarking is essential: Beyond just measuring close rates, effective proposal benchmarking tracks metrics like time spent on proposals, version history, and stakeholder engagement to identify performance patterns and refine the sales process.

- Proposals are deal confirmers, not makers: Proposals should align with buyer expectations and reflect prior discussions. Tools like Qwilr provide real-time engagement data, helping teams understand buyer intent and adjust strategies accordingly.

- Personalization is key: Real personalization goes beyond using a buyer’s name. Successful proposals address specific buyer concerns, using dynamic data to ensure each document is relevant and impactful.

- Friction points can be revealing: Whether it’s legal delays or multiple revisions, friction in the proposal process can point to areas needing improvement, such as better pre-proposal alignment or streamlined workflows.

- Success isn’t just about close rate: Proposal success should be measured holistically, considering factors like buyer trust, internal alignment, and sales efficiency. Proposal benchmarking offers insights into what truly drives engagement and accelerates deals.

What is proposal benchmarking?

Proposal benchmarking is the practice of measuring how your proposals perform to create a set of standards that help to identify strengths, weaknesses, and opportunities for improvement.

It tracks not just the close rate but also the time to closure, how many revisions the proposals require, and how stakeholders interact with them. It’s a way to bring structure and insight to what’s often an invisible part of the sales process.

Rather than relying on gut feel or anecdotal wins, benchmarking helps teams understand what “good” actually looks like. It establishes internal baselines (like average time from proposal sent to first customer response) and surfaces patterns that can improve future deals. For example, if proposals over a certain value consistently require additional legal review, benchmarking makes that visible early so teams can plan accordingly.

Ultimately, it’s about turning proposals into a repeatable advantage. By comparing performance over time and across deals, teams can spot what’s working, where friction occurs, and how to adapt faster. Done well, benchmarking doesn’t just improve proposals, it improves the process behind them.

The proposal has left the building

Let’s begin with the uncomfortable truth: by the time your proposal is “sent,” most of the heavy lifting should already be done.

Sam Rahmanian, CRO at Eftsure, puts it bluntly:

“Always agree to commercial terms, timelines, and discounts ahead of sending any proposal documentation. The Seller to Buyer relationship changes the moment the Buyer says they want to move forward. At that point, the Seller and Buyer go from opposing sides to being on the same team.” Too often, proposals are treated as deal-makers. In reality, they’re more like deal-confirmers. They reflect alignment, or expose its absence. This makes pre-proposal precision arguably more important than the proposal itself."

What should you really benchmark?

Win rate is the most obvious metric. But it’s also the bluntest.

Mael Hartl, Head of RevOps at Shippit, argues for a more layered approach:

“We track metrics like time spent in contract stages and stakeholder engagement, which help us see whether a proposal is progressing smoothly or stalling. We're also exploring deeper insights like response time, comment volume, and how many iterations a proposal typically takes to get across the line. For larger deals, we’re considering a stakeholder coverage score—something to assess how well we’re addressing each decision-maker’s needs. These metrics give us the feedback we need to improve in real-time, not just at the end of the deal.”

Think of proposal benchmarking like customer success metrics. The deal is the output. But… the magic lies in the inputs and moments in between:

- How many decision-makers viewed the proposal?

- Where did they linger? Where did they bounce?

- How many back-and-forth revisions were needed?

- Was legal friction disproportionate to deal size?

- Did procurement pushback stall or kill momentum?

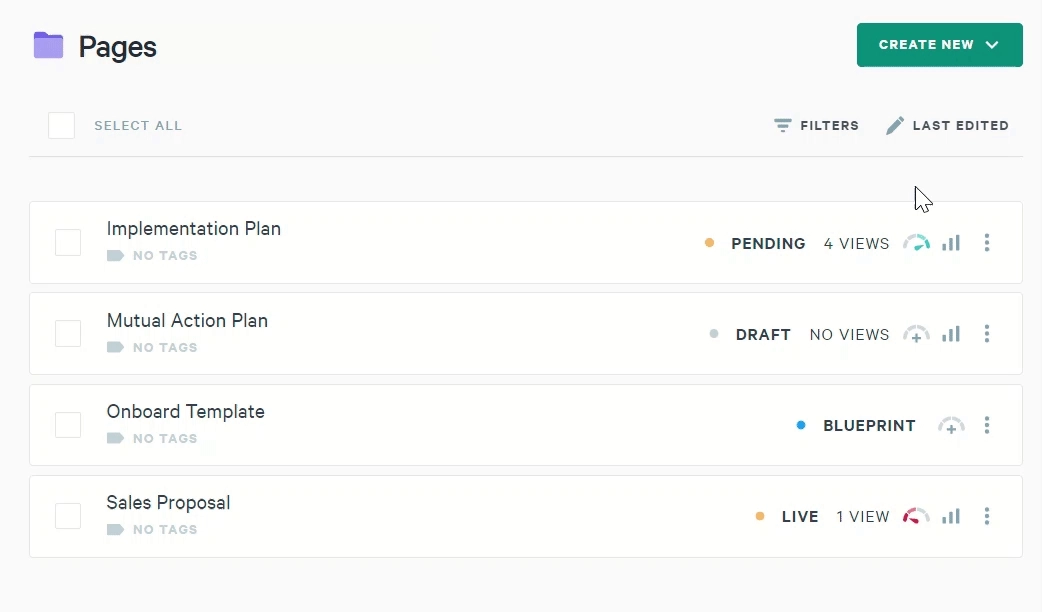

With Qwilr analytics, teams can capture detailed engagement data: like time spent on each section of a proposal or which stakeholders viewed it, turning static documents into sources of real-time buyer insight. That kind of data is foundational for effective benchmarking.

Qwilr’s key features include:

- Engagement metrics: See which sections of your proposal grab attention, helping you refine content.

- Reopen alerts: Get notified when a proposal is revisited, signaling renewed interest.

- Stakeholder tracking: Know who’s viewing your proposal and when, giving insight into decision-makers.

Where friction lives (and why it matters)

Every team hits snags! But the source of proposal friction tells you where to focus your process improvements.

For Sam Rahmanian, the trouble starts when proposals are rushed:

“Deals thrown around without a mutually agreed action plan, that’s when things fall apart.”

What about post-proposal, when you’re almost about to get that golden signature?

At Adiona, friction happens deeper in the funnel. Richard Savoie, CEO and co-founder, points to post-proposal bottlenecks:

“Our biggest challenge is contract negotiation with large enterprise clients. Legal back-and-forth eats time. But we’ve learned to pre-empt that by being easy to work with and building features that lower buyer effort, like auto-cleaning data.”

HowdyGo’s Umberto Anderle sees a similar pattern:

“Legal and security sign-off is where deals drag. That’s why clarity and personalisation in the proposal are so key. It reduces rework later.”

But it's not all legal battles, Hartl notes that they run into all sorts of friction points from "pricing discussions that trigger hesitation" to "shifting priorities or changes in stakeholder involvement."

There are plenty of potential friction points depending on your processes and product. Identifying them so that you can iron out the wrinkles is one of the biggest benefits of proper proposal benchmarking.

For this to work, proper benchmarking needs to reflect your sales motion, deal size, and customer segment: not simply some industry average.

One way to reduce these delays is by building proposals on platforms that support version control, real-time updates, and embedded approvals. Qwilr, for instance, makes it easy to collaborate on a single live proposal. The perk? You're not emailing PDFs back and forth while time kills momentum!

In essence, Qwilr helps you track where prospects are stalling on your proposals (hello, friction) and enables team interactions within proposals to avoid bottlenecks.

The personalisation mirage

Almost every expert we spoke to mentioned personalisation. But they weren’t talking about just the {firstName} tokens that are plastered on every sales document.

True personalisation, according to Anderle, means solving for problems the buyer raised:

“Personalisation is about whether the proposal solves for the pain points uncovered during the discovery process. Does it use the customer's language & terminology when addressing their problems or is it copy/pasted from a template? Does it address each problem one by one with a strong solution?”

Mael Hartl agrees:

“Buyers are under more pressure and have less time, which means proposals need to be sharper, faster, and more tailored than ever. There’s now an expectation for concise, personalised, and outcomes-focused proposals that cut through the noise.”

There’s a quiet revolution happening here. AI tools have made surface-level personalisation table stakes. Now, the question is whether your proposal proves that you were really listening or whether you’ve just used the broad AI personalization brush without thinking.

This is where Qwilr really shines. It allows reps to quickly create tailored proposals by using reusable content blocks and dynamic data. Reps can:

- Pull in pre-saved sections and customize them with client-specific details, saving time while ensuring each proposal feels unique.

- Qwilr also integrates with CRM systems, automatically pulling in up-to-date customer data and generating automated quotes, making the process faster and more accurate, allowing sales teams to focus on what matters: closing deals.

Who actually touches the proposal?

Proposal creation isn’t a solo sport, especially in high-value or enterprise deals.

At Shippit, proposals are cross-functional:

“Sales drives the deal, solution specialists validate the fit, RevOps handles tooling and ROI models, legal ensures compliance, and senior leaders weigh in on strategy”

That’s 5+ stakeholders for a single asset. But what’s interesting is how smaller companies are playing it differently.

HowdyGo? One person writes the proposal, another reviews it. That’s it.

Adiona? Two people, max - CEO included.

Eftsure? One to two.

Forefront Events? One.

There’s no ideal number. But the takeaway is this: Proposal benchmarking isn’t just about the output; it’s also about the process.

If four people are involved and the proposal still misses the mark, your workflow is broken. If you’re constantly hitting snags that require you to reach out to colleagues across different departments, then it’s clear they need to be involved from the start.

The invisible metric: buyer effort

A proposal doesn’t just communicate value, it asks for the buyer’s time and attention. And buyers are done reading decks for sport.

Buyer expectations have shifted, and we’re not the only ones who have noticed.

“Gone are the days of lengthy proposals - everyone wants short and sharp and compelling”

Dara Fitzpatrick - Director of Sales - Forefront Events.

Buyers are under pressure and have less time, as Hartl reiterates:

“Buyers expect relevance and brevity as standard.Proposals need to be sharper, faster, and more tailored than ever. Dense 50-page decks are out. ‘Less but clearer’ has become our mantra.”

Savoie took that even further, building a feature to auto-clean client data just to reduce friction and improve close rates.

“It’s not something we charge for, but conversion improved dramatically.”

This is an underutilised KPI: What’s the “effort-to-decide” ratio for your proposal?

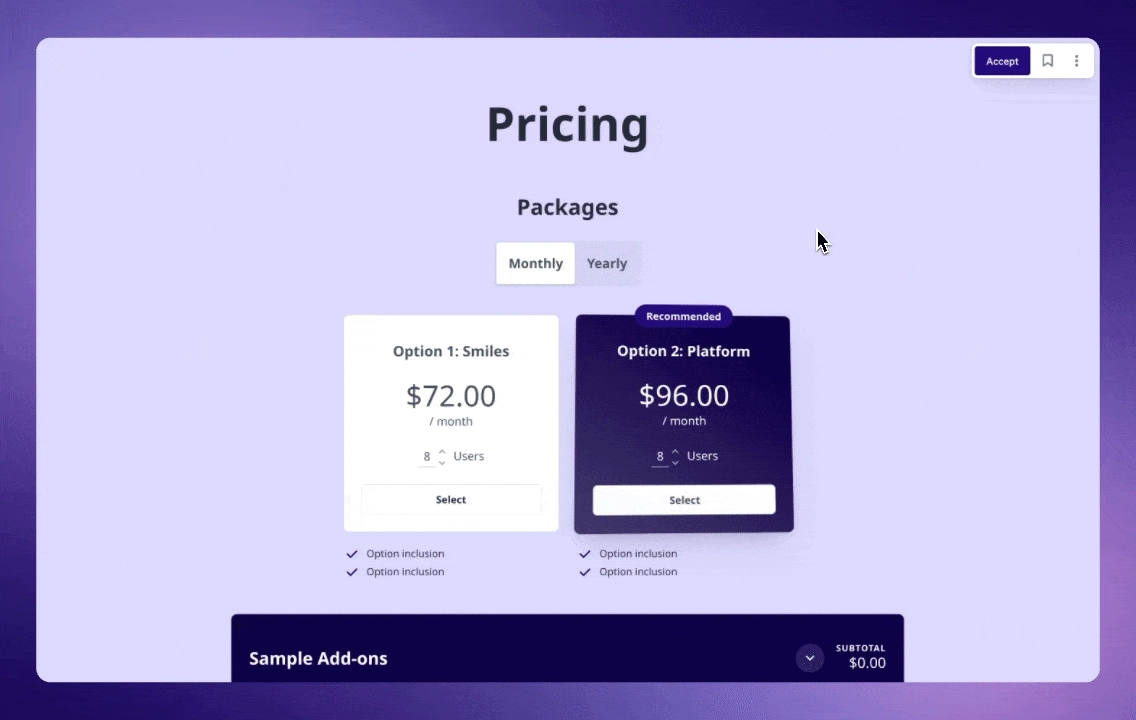

With Qwilr, you can streamline the entire signing process right within the proposal. There's no need for clients to download or open separate documents, which eliminates unnecessary steps and saves time. The proposal itself becomes an interactive experience.

Clients can: review, sign, and even make changes without leaving the platform. This seamless integration not only boosts efficiency but also reduces friction, allowing deals to close faster.

If your proposal is clear, visual, and maps tightly to buyer goals, you’ve reduced cognitive load. If it’s verbose, jargon-filled, or loaded with irrelevant company creds, you’ve made them do your job.

The best practices everyone still misses

We asked each contributor: What’s still being overlooked?

Here’s what stood out:

- Pre-proposal alignment: Hartl warns: “Teams rush to send a deck without confirming appetite, authority, or timing. Qualify properly upfront.”

- Multi-threading: “Engaging multiple decision-makers isn’t just for enterprise deals anymore,” he says. “Even mid-market buyers expect this.”

- Visual clarity: Anderle suggests: “Proposals should be understandable from one page. Screenshots, demos, and clear formatting go a long way.”

- Operational relevance: “Generic benefits don’t win deals,” Hartl says. “Tie your solution to real metrics that matter to the buyer’s day-to-day.”

- Qualitative feedback loops: Savoie taps into past prospects who’ve changed jobs. “They give incredibly honest feedback on what worked or didn’t. It’s a goldmine.”

The experts swear by the importance of personalisation and clarity. With platforms like Qwilr, teams can create proposals that not only feel bespoke, but also reflect a buyer’s language, priorities, and pain points - without starting from scratch every time.

There’s a quiet maturity to these insights. They reflect a shift from seeing proposals as static documents to treating them as living tools (tools that require context, empathy, and constant iteration!)

Proposal benchmarking metrics most teams overlook (but shouldn’t)

With a little help from our industry experts and in-depth data analysis conducted by the Qwilr team, we’ve put together the key proposal benchmarking metrics you shouldn’t miss.

The more people who view the proposal, the better

Qwilr analysed thousands of proposals created within our platform and our research found that having at least two additional unique views on a page within 5 days of it being sent increases the acceptance rate by 1.9x.

When a proposal is reopened five days after initial viewing, what does that mean? If it’s been dormant and suddenly gets attention, it could signal reactivation: a buyer bringing you back into the mix after reviewing competitors or deciding your proposal is worthwhile or being sent higher up the chain of command. Smart teams set alerts for this behavior and trigger re-engagement sequences or rep follow-ups.

Legal review duration

How long legal spends on a proposal might seem like a back-office concern, but it’s often a major bottleneck. If your legal clause formatting, terms, or indemnities consistently cause a delay in time-to-sign, that becomes a sales problem, not just a compliance one. Benchmarking average legal time can reveal when a proposal redesign (or a better MSA strategy) is needed.

Richard Savoie, CEO at Adiona Tech, highlights this exact issue:

“Our biggest challenge is contract negotiation with large enterprise clients. Legal back-and-forth eats time. But we’ve learned to pre-empt that by being easy to work with and building features that lower buyer effort.”

Proposal version history

Some reps send one polished proposal. Others send five revisions. Tracking version history helps you distinguish between efficient deal progression and potential indecisiveness. If a deal requires multiple back-and-forths, is that due to poor initial scoping, or is the buyer using it as a negotiation tactic? Benchmarking version counts gives you context.

Qualitative feedback from former buyers

Past buyers (especially those who’ve moved companies) can provide some of the most honest and unfiltered insights. Savoie shares how these interactions shaped their approach:

“We ask prospects who’ve changed jobs what they really thought of the sales process. They give incredibly honest feedback on what worked or didn’t. It’s a goldmine.”

The rise of multi-threading (even in mid-market)

Multi-threading isn’t just an enterprise tactic anymore. As Mael Hartl from Shippit notes:

“Engaging multiple decision-makers isn’t just for enterprise deals. Even mid-market buyers expect this now.”

Tracking how many stakeholders engage with a proposal - and which ones - offers more predictive value than top-line deal size alone.

The shorter your proposal, the more likely it’ll be accepted

This is clear by now, based on the insights from industry experts, but our research backs this up too. We found that proposals created in Qwilr that use less than six blocks have a 1.66x higher chance of closing.

The longer prospects engage, the more likely they are to close

This really seems like a no-brainer. But the challenge comes in when you’re trying to keep your proposal short enough to keep up with buyer expectations yet still engaging enough that prospects actually spend time on it.

Our research shows that a minimum of four minutes engagement is what you’re aiming for. Prospects who spend four minutes or more on your proposal are 11x times more likely to close.

We’re all about interactive proposals here at Qwilr (goodbye PDFs). Engage clients with embedded videos, dynamic pricing tables and interactive ROI calculators to communicate value while maintaining brevity.

Rethinking success: beyond closed won

Ultimately, proposal benchmarking should tell a story. Not just of wins and losses, but of:

- Buyer trust built (or lost)

- Sales efficiency gained (or dragged)

- Internal alignment fostered (or fractured)

Proposals don’t operate in a vacuum. They reflect how well your sales process understands its buyer, how clearly your team aligns on value, and how effectively you translate that into a compelling, human document.

So ask yourself:

- Do you know where your proposals lose attention?

- Do you know which sections actually help move the deal forward?

- Do you benchmark the moments that matter, or just the final outcome?

If your answer is “not yet,” you're not alone. But you're also leaving a lot of insight on the table.

Case study: How Stafflink streamlined recruitment proposals with Qwilr

Stafflink, an Australian IT recruitment agency, faced challenges with their traditional proposal process. Using PDFs and Word documents, they found it time-consuming to create and update proposals, leading to inefficiencies and a lack of engagement tracking.

By adopting Qwilr, Stafflink transformed its proposal workflow. They leveraged Qwilr's customizable templates and interactive features to create visually appealing, web-based proposals. This not only reduced the time spent on proposal creation but also allowed for real-time updates and seamless collaboration.

One of the significant advantages Stafflink experienced was the ability to track client engagement. With Qwilr's analytics, they could see which sections of the proposal clients viewed and how much time they spent on each part. This insight enabled them to tailor follow-up conversations more effectively, addressing specific client interests and concerns.

The result was a more efficient proposal process, improved client engagement, and a higher conversion rate. Stafflink's experience demonstrates how modernizing proposal tools can lead to tangible business benefits.

Benchmark like a boss

Proposal benchmarking isn’t about chasing averages. It’s about surfacing signals in the noise. Why? So you can design sharper processes, deliver smarter documents, and sell the way today’s buyers actually want to buy.

Proposal benchmarking is a discipline, but the right tools make it scalable. If you're ready to go beyond PDFs and track what really drives buyer engagement, Qwilr can help turn your proposals into a strategic advantage. Sign up for a free trial and see for yourself.

About the author

Brendan Connaughton|Head of Growth Marketing

Brendan heads up growth marketing and demand generation at Qwilr, overseeing performance marketing, SEO, and lifecycle initiatives. Brendan has been instrumental in developing go-to-market functions for a number of high-growth startups and challenger brands.