You’ve found the perfect place: hardwood floors, a dreamy kitchen, and just the right amount of charm. You’re already picturing lazy Sunday mornings and arguing over which movie to watch on a Friday night. But before you pop the champagne, there’s one tiny, not-at-all-romantic detail: the contract.

Real estate contracts hold the power to make your property dreams come true or trap you in a legal nightmare involving contingencies, escrow, and clauses sneakier than a nosy neighbor.

Let’s break it down so you can sign with confidence, knowing exactly what’s in the fine print before you say, Honey, I’m home!

Key takeaways:

- A real estate contract outlines all terms and conditions of a transaction, making sure everyone knows what’s expected. It’s all about ensuring no one’s left scratching their head about contingencies, payments, and obligations.

- Using standardized templates is tempting, but tailoring them to your specific deal is crucial. Make sure every detail is addressed, from contingencies to payment terms, so your contract is rock solid.

- Contingencies such as financing and inspections can protect you from potential headaches down the road. Always include them and keep timelines realistic!

- Whether it’s a real estate agent or an attorney, having a pro on your side can save you from a lot of future trouble. Sometimes the best investment is a second set of eyes.

What is a real estate contract?

A real estate contract is a legally binding agreement that outlines the terms and conditions of a property transaction, whether buying, selling, or leasing. It establishes the rights and responsibilities of each party, ensuring mutual understanding and protecting against potential disputes. To be legally enforceable, the contract must include key elements such as mutual consent, a lawful purpose, and a valid offer and acceptance. By clearly defining expectations and remedies for non-compliance, a well-drafted contract helps facilitate a smooth transaction and safeguards all involved parties.

Key Components:

- Offer and acceptance – One party offers a deal, and the other accepts it. Without mutual consent, the contract is void.

- Legal consideration – The exchange of something of value, typically money or other forms of consideration.

- Legality – The transaction must be lawful and not involve illegal activities.

- Capacity – All parties involved must have the legal capacity to enter into a contract (i.e., be of legal age and of sound mind).

Types of real estate contracts

Brace yourself for an array of real estate contract options, all dependent on the nature of the transaction and the roles of the parties involved. Here's an overview:

- Purchase agreement

This is the most common real estate contract, used when a buyer agrees to purchase property from a seller under specific terms and conditions. It can apply to residential, commercial, or newly constructed properties.

Key Terms: Price, contingencies, closing dates, and other conditions.

Who signs the contract? Both the buyer and the seller.

- Lease agreement

A lease agreement is used when a property owner rents property to a tenant for a specified period. It includes residential leases for homes or apartments and commercial leases for businesses.

Key Terms: Rent amount, lease duration, renewal options, and tenant’s responsibilities.

Who signs the contract? Both the landlord and the tenant.

- Rental agreement

Typically shorter-term (month-to-month) than a lease, rental agreements offer flexibility to both the landlord and tenant.

Key Terms: Rent, payment deadlines, termination notice periods.

Who signs the contract? Both the landlord and the tenant.

- Option contract

This contract grants the buyer the exclusive right to purchase a property at a later date, often at a fixed price. It’s often used by investors.

Key Terms: Option fee, expiration date, and purchase price.

Who signs the contract? The property owner and the prospective buyer.

- Land contract (seller financing)

A type of seller financing where the buyer makes payments directly to the seller over time. The seller retains legal title to the property until the full purchase price is paid.

Key Terms: Payment schedule, interest rate, and deed transfer upon final payment.

Who signs the contract? The seller (property owner) and the buyer.

- Assignment contract

Typically used in wholesaling, the contract is assigned to another buyer (usually for a fee). The original buyer secures a property under contract and transfers it to a third party.

Key Terms: Assignment fee, terms of assignment.

Who signs the contract? The original contract holder and the new buyer.

- Power of Attorney for real estate transactions

This document gives another person the legal authority to act on behalf of the property owner. It’s often used when the owner is unavailable or incapacitated.

Key Terms: Scope of authority, limitations, duration.

Who signs the contract? The property owner (grantor) and the designated agent or attorney-in-fact.

Who prepares real estate contracts?

Real estate contracts don’t just appear out of thin air - they’re that next step after nailing a real estate proposal, and someone has to do the paperwork! And depending on the complexity of the deal, that someone can vary. Whether it’s a seasoned real estate agent using a tried-and-true template or an attorney ensuring every legal loophole is closed, the contract’s author needs to know what they’re doing:

- Real estate agents and brokers: Agents commonly use standardized contract templates approved by local real estate associations. These templates are legally vetted and customizable for specific transactions.

- Real estate attorneys: Lawyers are often employed for more complex contracts or in situations requiring legal advice to ensure compliance with local laws and regulations.

- Title companies: In some jurisdictions where attorneys aren't required for closings, title companies may assist in preparing contracts, particularly for more straightforward transactions.

- Buyers and sellers: In certain cases, buyers and sellers may draft contracts themselves using templates. However, it's always advisable to have a legal professional review any self-drafted contracts.

What to include in the contract

So if real estate contracts are the prenuptial agreements of home buying or real estate investment. Do you really want to leave everything to chance when buying your ideal property? Na. You want everything spelled out clearly, including any amendments and addendums, so there are no surprises (or legal headaches) down the road.

Identification of the parties

Full legal names and contact details of all involved parties. This clarifies who is entering into the contract and ensures that everyone is correctly identified.

Property description

A precise description of the property being sold, including the address, lot number, and any relevant identifiers like tax parcel numbers.

Purchase price and payment terms

The total price of the property, including any deposit amounts, down payments, or financing terms. The payment schedule and the method of financing should be clearly defined, including contingencies for securing a loan.

Earnest money deposit

A deposit that the buyer makes as a sign of good faith. The contract should specify the amount of earnest money, where it will be held (usually in escrow), and the conditions under which it is refundable or forfeited.

Escrow(FYI) is like a neutral safety deposit box for real estate transactions. It’s a secure, third-party holding arrangement where money, documents, or assets are kept until all conditions of a deal are met.

Contingencies

These are conditions that must be met for the contract to be enforceable. Common contingencies include:

Financing contingency: Ensures the buyer can secure financing (a loan).

Inspection contingency: Gives the buyer the right to inspect the property and negotiate repairs or cancel the contract.

Appraisal contingency: Ensures the property is appraised at or above the agreed-upon price.

Closing date and possession terms

The date when the property sale will be finalized and when the buyer will take possession of the property.

Disclosures and representations

Sellers are legally required to disclose known defects or issues with the property. This section may also cover issues such as zoning compliance, environmental concerns, and warranties.

Default and remedies

Defines the consequences if either party defaults on the contract, such as penalties, legal actions, or loss of earnest money.

Signatures and dates

All parties involved in the contract must sign and date the document. In some jurisdictions, digital signatures may be valid.

Crucial advice for writing a real estate contract

We’ve given this section horns - simply because a valuable tip goes a long way. Here are some practical recommendations to consider when drafting or reviewing a real estate contract:

1. Use standardized templates with caution

While it’s convenient to use standard real estate contract templates, always tailor contracts to the specific deal. Generic templates might not cover all the unique terms or contingencies required for your transaction.

Ensure you review every section and customize it based on your specific property, parties, and transaction details. Always remove any irrelevant clauses that don’t apply to your deal.

2. Always include contingencies for protection

Back yourself! Contingencies give both parties a way out if certain conditions aren’t met. So never leave these out, as they provide flexibility and safeguard your investment.

Ensure that the contract includes common contingencies such as financing, inspections, appraisals, and even the sale of an existing property (if applicable). Be specific about timelines for contingencies to be fulfilled.

3. Be clear about payment terms and deadlines

Seems uncomfortable, but it must be discussed. Misunderstandings about payment schedules and deadlines can lead to disputes. The more clarity you provide in this section, the smoother the transaction will be.

Clearly state the total purchase price, down payment amount, escrow deposit, and who will handle payments (buyer/seller or third party). Include deadlines for when payments are due and the consequences for late payments. If financing is involved, outline the loan approval process and expected closing date. Basically, tick all the awkward boxes and add every necessary addendum.

4. Don't forget property conditions and inspection rights

Protect yourself as a buyer by securing your right to inspect the property before finalizing the deal. Sellers should be upfront about the property's condition to avoid future legal issues. Bring your magnifying glass and notebook. You want to know exactly what you’ve got.

If you’re a buyer, specify the exact inspection rights you’re entitled to and the period in which the inspection must be completed. If you're a seller, disclose any known defects upfront to avoid post-sale conflicts. Also, mention who will pay for repairs (if any) after the inspection.

5. Specify who will pay closing costs

Closing costs can vary and be a point of confusion. Clarify upfront who is responsible for what costs to avoid surprises at the closing table.

List all the closing costs (e.g., agent fees, inspection fees, title insurance) and explicitly state who will be responsible for each. If you're the buyer, you may want to negotiate for the seller to cover some or all of the costs.

7. Keep the timeline realistic

Time is often a critical factor in real estate deals. Set realistic and achievable timelines to avoid unnecessary delays or breaches of contract.

Build in buffer time where needed. Keep in mind that market conditions, like lender processing times or inspection availability, can impact your timeline.

2. Always include contingencies for protection

Back yourself! Contingencies give both parties a way out if certain conditions aren’t met. So never leave these out, as they provide flexibility and safeguard your investment.

Ensure that the contract includes common contingencies such as financing, inspections, appraisals, and even the sale of an existing property (if applicable). Be specific about timelines for contingencies to be fulfilled.

3. Be clear about payment terms and deadlines

Seems uncomfortable, but it must be discussed. Misunderstandings about payment schedules and deadlines can lead to disputes. The more clarity you provide in this section, the smoother the transaction will be.

Clearly state the total purchase price, down payment amount, escrow deposit, and who will handle payments (buyer/seller or third party). Include deadlines for when payments are due and the consequences for late payments. If financing is involved, outline the loan approval process and expected closing date. Basically, tick all the awkward boxes and add every necessary addendum.

4. Don't forget property conditions and inspection rights

Protect yourself as a buyer by securing your right to inspect the property before finalizing the deal. Sellers should be upfront about the property's condition to avoid future legal issues. Bring your magnifying glass and notebook. You want to know exactly what you’ve got.

If you’re a buyer, specify the exact inspection rights you’re entitled to and the period in which the inspection must be completed. If you're a seller, disclose any known defects upfront to avoid post-sale conflicts. Also, mention who will pay for repairs (if any) after the inspection.

5. Specify who will pay closing costs

Closing costs can vary and be a point of confusion. Clarify upfront who is responsible for what costs to avoid surprises at the closing table.

List all the closing costs (e.g., agent fees, inspection fees, title insurance) and explicitly state who will be responsible for each. If you're the buyer, you may want to negotiate for the seller to cover some or all of the costs.

7. Keep the timeline realistic

Time is often a critical factor in real estate deals. Set realistic and achievable timelines to avoid unnecessary delays or breaches of contract.

Build in buffer time where needed. Keep in mind that market conditions, like lender processing times or inspection availability, can impact your timeline.

2. Always include contingencies for protection

Back yourself! Contingencies give both parties a way out if certain conditions aren’t met. So never leave these out, as they provide flexibility and safeguard your investment.

Ensure that the contract includes common contingencies such as financing, inspections, appraisals, and even the sale of an existing property (if applicable). Be specific about timelines for contingencies to be fulfilled.

3. Be clear about payment terms and deadlines

Seems uncomfortable, but it must be discussed. Misunderstandings about payment schedules and deadlines can lead to disputes. The more clarity you provide in this section, the smoother the transaction will be.

Clearly state the total purchase price, down payment amount, escrow deposit, and who will handle payments (buyer/seller or third party). Include deadlines for when payments are due and the consequences for late payments. If financing is involved, outline the loan approval process and expected closing date. Basically, tick all the awkward boxes and add every necessary addendum.

4. Don't forget property conditions and inspection rights

Protect yourself as a buyer by securing your right to inspect the property before finalizing the deal. Sellers should be upfront about the property's condition to avoid future legal issues. Bring your magnifying glass and notebook. You want to know exactly what you’ve got.

If you’re a buyer, specify the exact inspection rights you’re entitled to and the period in which the inspection must be completed. If you're a seller, disclose any known defects upfront to avoid post-sale conflicts. Also, mention who will pay for repairs (if any) after the inspection.

5. Specify who will pay closing costs

Closing costs can vary and be a point of confusion. Clarify upfront who is responsible for what costs to avoid surprises at the closing table.

List all the closing costs (e.g., agent fees, inspection fees, title insurance) and explicitly state who will be responsible for each. If you're the buyer, you may want to negotiate for the seller to cover some or all of the costs.

7. Keep the timeline realistic

Time is often a critical factor in real estate deals. Set realistic and achievable timelines to avoid unnecessary delays or breaches of contract.

Build in buffer time where needed. Keep in mind that market conditions, like lender processing times or inspection availability, can impact your timeline.

8. Have a legal professional review the contract

This is where your aunty’s cousin twice removed comes in handy if she’s an attorney. Even if you're using templates, having a lawyer review the contract is essential, especially for complex transactions. They can spot any legal loopholes or unaddressed risks.

If there’s no contact you can lean on, hire an attorney who specializes in real estate law to review the contract before you sign it. This will help ensure that the contract is legally binding, protects your interests, and complies with local laws and regulations.

9. Keep communication open between parties

Open communication between the buyer, seller, and any third-party professionals (like agents or attorneys) can prevent misunderstandings and streamline the process.

You want to regularly check in with all parties involved to make sure that deadlines are met and that everyone is on the same page. Any changes or updates to the contract should be communicated clearly and immediately.

10. Address future disputes in the contract

Sure, you’re holding thumbs that everything goes well. But having a dispute resolution clause in place can save time, money, and stress if disagreements arise.

Include a dispute resolution process in the contract, such as mediation or arbitration, which is often less costly and time-consuming than court litigation. Specify the jurisdiction and venue for resolving disputes as well.

11. Understand local and state laws

Real estate laws vary significantly by location, so what works in one state or place may not be applicable in another.

Research the specific real estate laws in your jurisdiction or work with a professional who understands the local market. This ensures that your contract complies with state-specific rules related to disclosures, tax obligations, and property rights.

Contract curation made easy

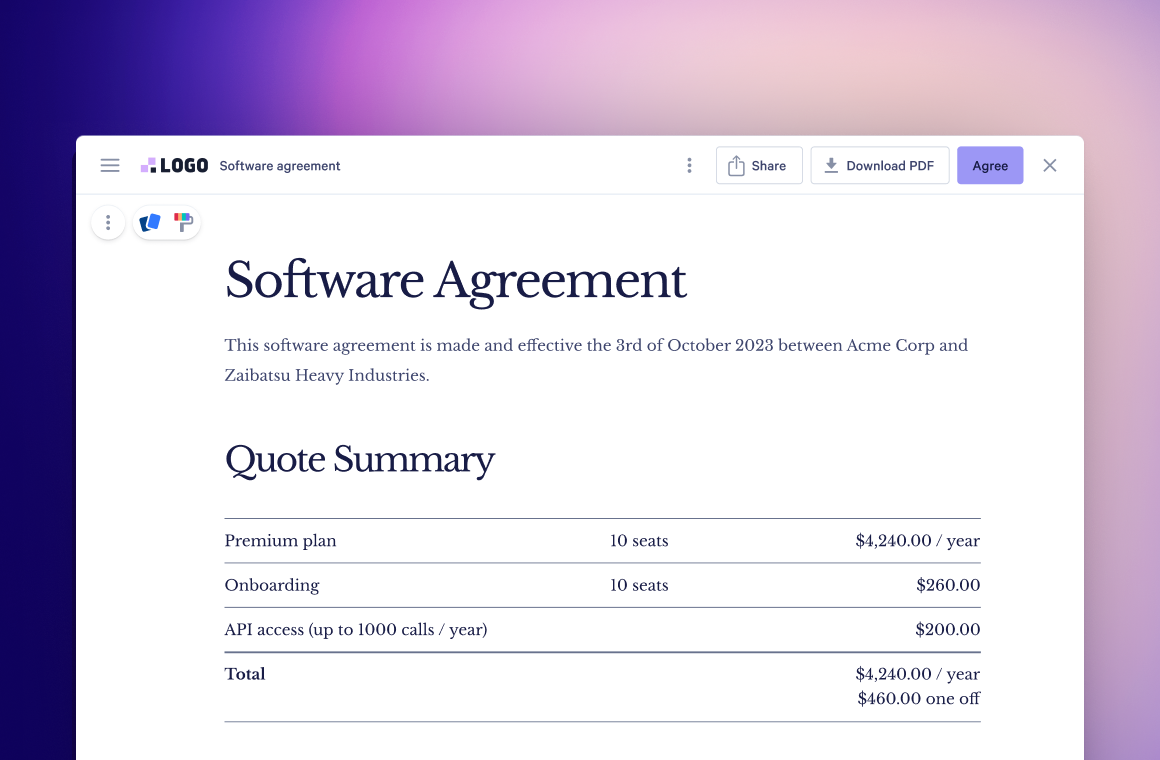

Qwilr is a powerful tool designed to simplify and streamline the process of creating professional documents, whether you're working on real estate contracts, proposals, or any other type of agreement.

With Qwilr you can collapse multiple processes into one: Send a dazzling real estate proposal, attach a legal plain-text agreement, and secure e-signatures and payments on the same document!

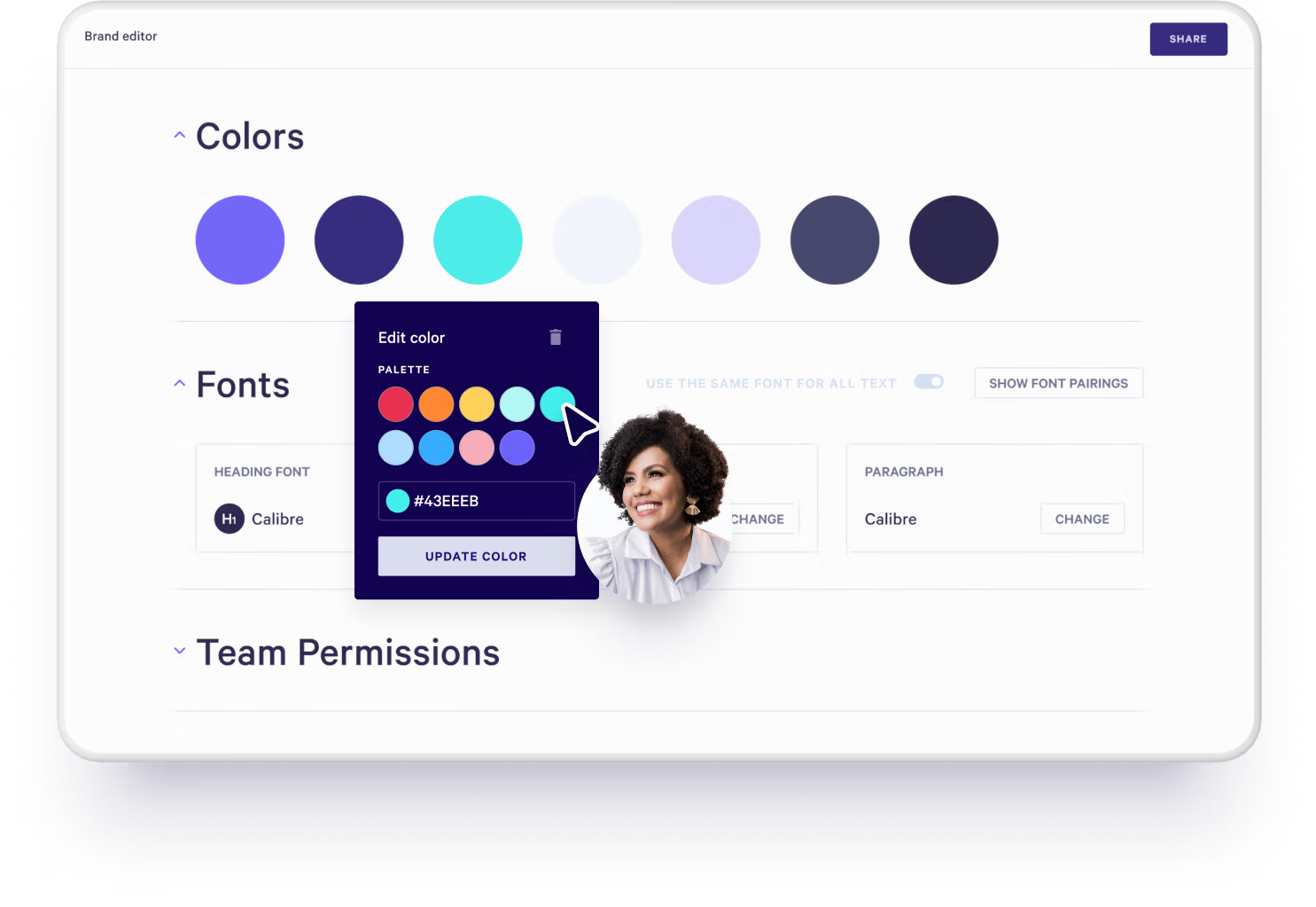

- Customizable templates: Remember when we said to use standardised templates with caution? Qwilr offers a range of pre-designed, fully customizable proposal templates, so you can create a document that fits your specific needs without starting from scratch. Plug in your details or upload a PDF and tailor the layout and content — add your plain-text contract alongside and you’re ready to go!

- Drag-and-drop editor: The user-friendly, drag-and-drop editor lets you quickly add or adjust elements within your document. Not an IT guru? No problem. No coding or design experience is needed - just a simple, intuitive interface to get the job done fast.

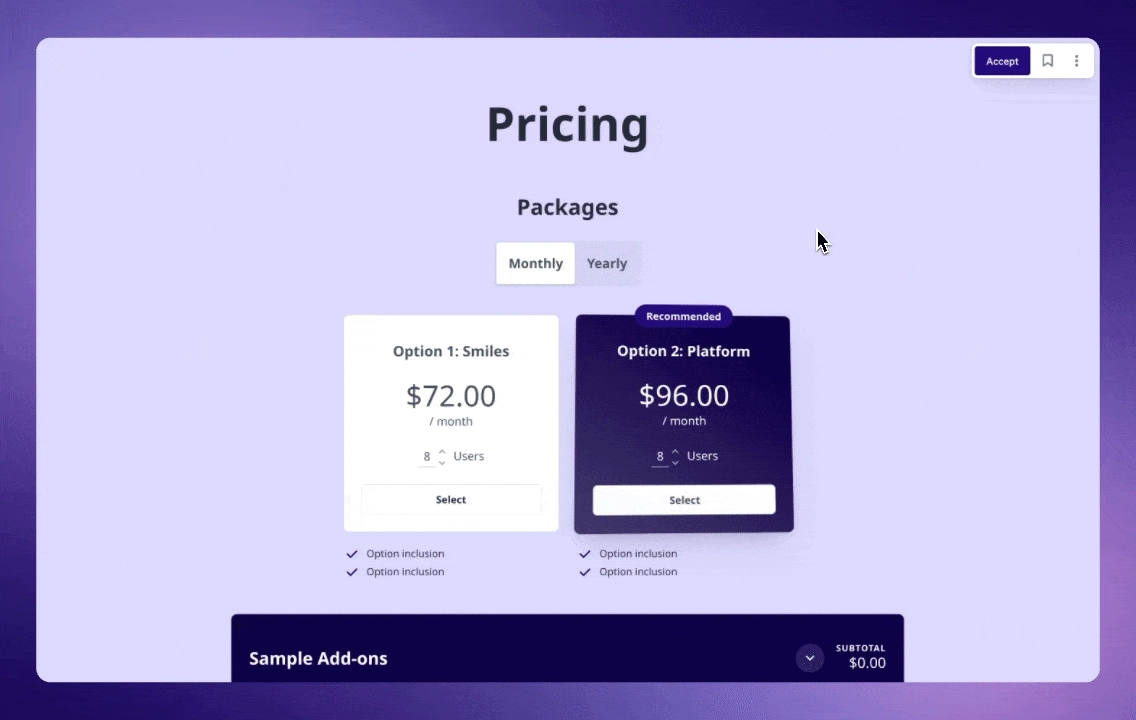

- Interactive features: Qwilr allows you to add interactive elements such as forms, embedded videos, and dynamic pricing tables. We don’t back boring. These features make your documents more engaging and informative, enhancing the buyer’s experience.

- E-signature integration: Out with the old - i.e. pen and paper. You can add e-signatures directly to your documents, making it easy for recipients to sign contracts.

- Add your agreements: A major new perk: incorporate agreements into your contract without needing to print, scan, or fax anything. It’s secure, efficient, and legally binding.

- Real-time collaboration: Let everyone chime in! Multiple users can collaborate on a document in real time. Share your Qwilr document with others for review or feedback, and make live edits. This makes it easier to ensure all parties are aligned before finalizing the agreement.

- Client tracking & analytics: Qwilr offers built-in tracking features, allowing you to see when and how recipients interact with your document. You’ll know if they’ve opened it, how long they spent reading it, and what sections they spent the most time on, giving you valuable insight into client interest and engagement.

- Seamless payment integration: For transactions requiring payments, Qwilr allows you to integrate payment options directly into your documents. Whether it's a deposit, a full payment, or any other amount, recipients can pay with ease, streamlining the process.

- Mobile-friendly: If you’re in an Uber or on the train and need to get things done, Qwilr’s templates are mobile-optimized, meaning your documents look great and function perfectly on any device. This is especially helpful for clients who may need to review or sign documents while on the go.

- Security & compliance: Qwilr ensures your documents are secure, offering features like password protection, encryption, and audit trails. This provides peace of mind when dealing with sensitive information.

Qwilr, at your service

When it comes to real estate contracts, using legal jargon and contingencies is par for the course. You’ve got to balance all those clauses, contingencies, and terms while making sure everything’s airtight. Is it fun? Maybe not. Is it important? Absolutely. Because let’s face it: nobody wants a surprise when it comes to their dream property.

So, what’s the key takeaway? Pay attention. Be thorough. Double-check. Still unsure? A real estate pro or attorney can save your skin. After all, when it comes to contracts, it’s always better to be safe than sorry - unless you like surprises (and not the good kind).

About the author

Brendan Connaughton|Head of Growth Marketing

Brendan heads up growth marketing and demand generation at Qwilr, overseeing performance marketing, SEO, and lifecycle initiatives. Brendan has been instrumental in developing go-to-market functions for a number of high-growth startups and challenger brands.