Modern sales management is about pipeline clarity, automation that actually saves time, and fast, frictionless deal execution.

Below are ten leading platforms - from full CRM suites to specialist sales engines. Expect deep feature notes, pros/cons, and clear guidance on when to choose each.

Snapshot of our picks

| Sales Management Software | How It Works | Best For | Trade-offs |

|---|---|---|---|

Qwilr | Interactive proposals/quotes pulling CRM data, tracking engagement, supporting e-sign + payments, with automation. | Teams sending lots of proposals; fast, frictionless closing; CRM-connected quoting. | Not a CRM; requires template setup; less value if proposals are infrequent. |

Outreach | Multichannel outbound engine with sequences, AI-driven task prioritization, conversation intelligence. | SDR/BDR teams; outbound motions; pipeline creation. | Learning curve; can be complex for small teams. |

LinkedIn Sales Navigator | Buyer intelligence + lead recommendations + account updates based on LinkedIn data. | Social selling; ABM; building high-quality prospect lists. | No outreach automation; pricey for large teams. |

Seismic | Content enablement: stores, personalizes, distributes, and analyzes sales content performance. | Sales enablement teams; content-heavy enterprises. | Requires onboarding; best for larger orgs. |

InsightSquared | Advanced forecasting, revenue analytics, and pipeline quality reporting. | RevOps, forecasting-heavy orgs, CROs. | Requires solid CRM data hygiene; mid-market+ teams. |

Gong | Revenue intelligence: call recording, AI coaching, deal risk insights, pipeline guidance. | Sales leaders; teams with heavy calls/meetings; coaching-focused orgs. | Not for outreach; needs call volume. |

Pipedrive | Visual pipeline CRM with simple automation, email sync, and AI reporting. | Teams wanting a clean, visual CRM; SMBs. | Limited forecasting; some features only in higher tiers. |

Freshsales | Multi-channel CRM with calling, email, AI scoring, and sequences. | Teams needing built-in communication + AI prioritization. | Less customizable; AI improves with data. |

Microsoft Dynamics 365 Sales | Microsoft-first CRM with Outlook/Teams embedding, forecasting, and AI insights. | Microsoft-heavy enterprises. | Complex licensing and setup. |

1. Qwilr - Interactive proposals that close deals

Qwilr specializes in creating interactive, web-based proposal and quote pages that are dynamic, trackable, and designed to convert. Sales reps build proposal templates that automatically pull in data from the CRM (like contact name, deal value, line items) using tokens. When a deal reaches a proposal-ready stage, Qwilr can generate a page, send it, and notify the sales team when the prospect interacts with it.

Document analytics at its best: Once the prospect views the proposal, Qwilr tracks how long they spend on each section, which pricing options they engage with, and how they move through the quote. This data flows back to your CRM (via integrations), so you can use engagement as a reliable signal for next steps.

Proposals built in Qwilr support configurable pricing tables: you can offer tiered plans, optional add-ons, discount lines, and let the buyer toggle between options live. When they accept, you can get e-signatures directly on the page, and even collect payments with QwilrPay, consolidating acceptance and payment in a single flow.

Qwilr supports automation: workflows can trigger the creation of a proposal, notify stakeholders, or update CRM stages based on recipient behavior.

Pricing

- Business Plan: $35 /user/month (billed annually) for smaller teams. Includes core proposal tools (content editor, e-sign, pricing & quotes, page analytics) and integrations with CRMs like HubSpot, Pipedrive, and Zoho.

- Enterprise Plan: $59 /user/month (billed annually, minimum 10 users) with advanced features: custom branding, team permissions, PDF export, richer analytics, and deeper CRM automation.

Strengths & ideal use cases

- Perfect for teams that send a lot of proposals or quotes and want to make them more engaging.

- Excellent for closing faster and reducing back-and-forth negotiation.

- Great when you want real engagement data (which sections prospects spend time on) to prioritize follow-up.

- Works strongly in tandem with a CRM: you use your CRM for pipeline and lead management, and Qwilr for the final “proposal-to-sign” stage.

Trade-offs

- Doesn’t replace a CRM: you still need a CRM for lead capture, forecasting, and contact management.

- Requires setup around templates and data tokens to really scale.

2. Outreach - Outbound automation + pipeline generation

Outreach is a leading outbound sales execution platform. SDRs and AEs build automated multichannel sequences (email, call tasks, LinkedIn steps, SMS) that guide reps through daily activities with prioritized task queues.

Its AI engine, Outreach Kaia, provides call summaries, objection handling cues, and live note suggestions. Managers get dashboards showing sequence performance, rep activity, and pipeline creation health.

You can integrate Outreach with your CRM (HubSpot, Salesforce, Pipedrive, etc.) to sync activities and update pipeline stages automatically.

Pricing

Not publicly listed; typically mid-market to enterprise pricing, starting around $100–$145/user/month depending on modules.

Strengths & ideal use cases

- High-volume outbound teams needing automation

- SDR/BDR orgs with strict activity cadences

- Sales teams that want AI assistance during live calls

Trade-offs

- Requires onboarding to set up sequences and governance

- Can be overkill for very small teams

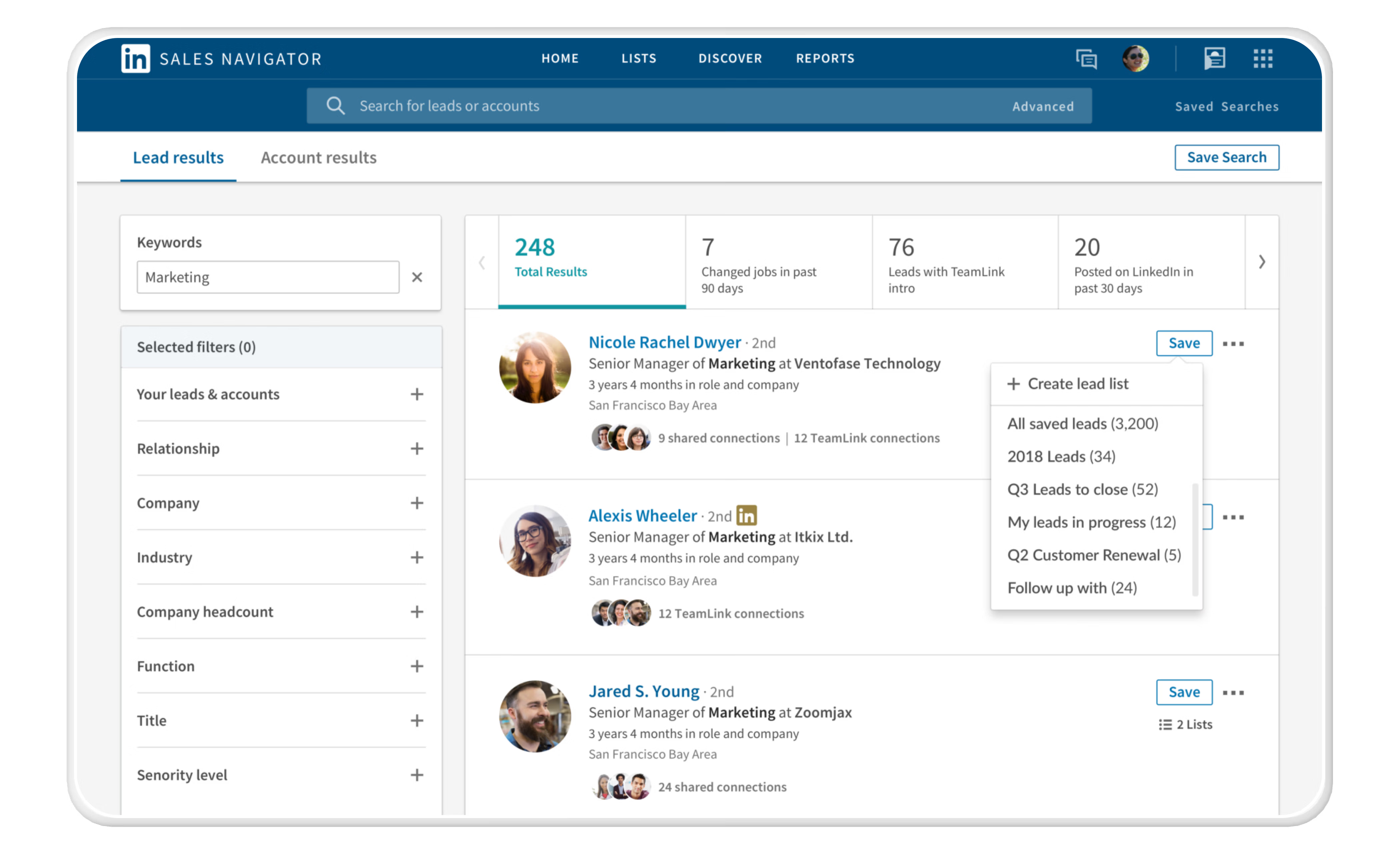

3. LinkedIn Sales Navigator - Social selling & buyer intelligence

Sales Navigator taps into LinkedIn’s global professional graph to deliver lead recommendations, buyer intent, account updates, and relationship insights.

You can track buying committees, see job changes (a major trigger event), and save custom lead lists. It integrates with CRMs so profile views, InMail conversations, and account signals show inside deals.

Pricing

- Core: ~$99/month

- Advanced: ~$149/month

- Advanced Plus: Custom enterprise pricing

Strengths & ideal use cases

- Ideal for ABM and high-targeted prospecting

- Great for building warm lists and engaging across buying committees

- Perfect for relationship-led sales

Trade-offs

- Doesn’t replace outreach tools - no sequence automation

- Pricey for large teams

4. Seismic - Enterprise-grade sales enablement

Seismic centralizes all sales collateral - case studies, decks, one-pagers, product sheets - and personalizes them at scale. Reps can auto-generate tailored content based on buyer industry, stage, or persona.

It provides analytics on content usage and revenue influence, showing which assets actually help close deals. Integrates with CRMs, CMS tools, and outreach platforms.

Pricing

Custom enterprise pricing; generally mid-five figures annually.

Strengths & ideal use cases

- Content-heavy orgs with distributed sales teams

- Enterprise enablement teams needing governance + personalization

- Teams wanting deep analytics on content ROI

Trade-offs

- Requires clear content ops processes

- Best for mid-market and enterprise, not small teams

5. InsightSquared - Forecasting + revenue analytics

InsightSquared sits on top of your CRM and transforms raw data into accurate forecasts, pipeline snapshots, trendline insights, and rep performance analytics.

It highlights pipeline gaps, risk patterns, and deal slippage. RevOps teams rely on it for replacing spreadsheet-based forecasting and building board-ready dashboards.

Pricing

Typically $50–$120/user/month, depending on modules and data sources.

Strengths & ideal use cases

- CROs and RevOps needing data-driven forecasting

- Companies with complex pipelines or multiple teams

- Leaders tired of messy CRM reports

Trade-offs

- Requires clean CRM data

- Overkill for very small orgs

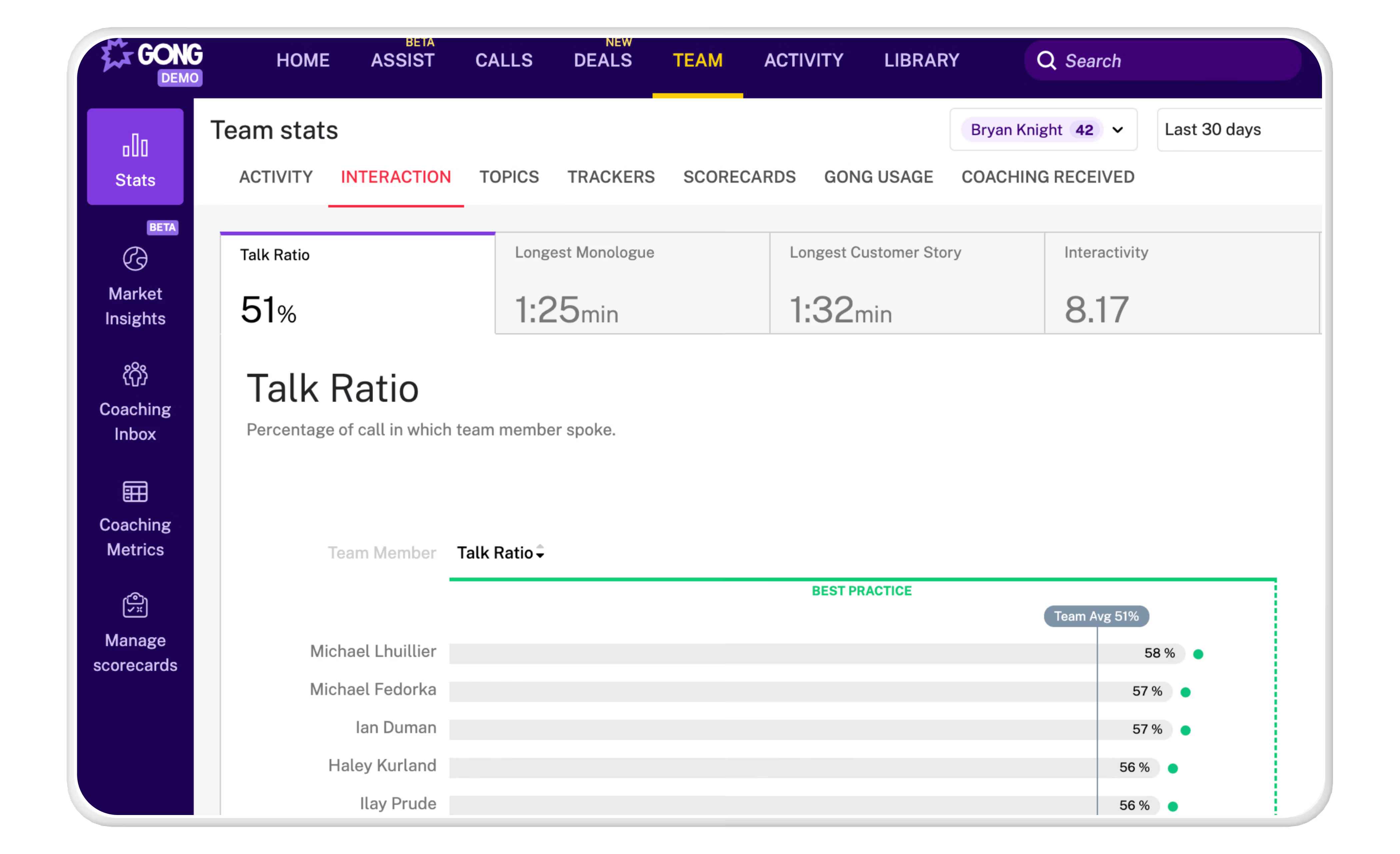

6. Gong - Revenue intelligence, deal risk & coaching

Gong automatically records, transcribes, and analyzes sales calls, emails, and meetings. It identifies deal risks (no next steps, single-threading, stalled timelines), coaching opportunities, and buyer sentiment.

Pipeline boards highlight risky deals and forecast confidence, making it a powerful management tool - far beyond call recording.

Pricing

Pricing is not public.

Strengths & ideal use cases

- Coaching-heavy sales orgs

- Teams wanting deep visibility into calls + deals

- Leadership teams wanting actionable revenue insights

Trade-offs

- Works best when call volume is high

- Not an outreach tool

7. Pipedrive - Visual pipeline management with lightweight automation

Pipedrive is a sales-first CRM, built around a visual, drag-and-drop pipeline that makes it easy for reps to move deals through stages. Each deal shows up as a card on your pipeline board, and reps can quickly update stages, add activity reminders, or log calls.

You can attach tasks to deals (calls, emails, follow-ups), plus set up automations for repetitive actions (e.g., when a deal enters a stage, send an email or create a task). Pipedrive supports email syncing, scheduling, and forecasting. They also provide AI-powered reporting and a real-time sales feed.

Pipedrive integrates with many tools, including document and proposal systems, so you can tie in Quote/Proposal generation (e.g., Qwilr) as part of your deal flow.

Pricing

Based on Pipedrive’s public pricing:

- Lite: US$14/user/month (billed annually) - basic pipeline, lead management, report creation.

- Growth: US$24/user/month (billed annually) - includes full email sync, automations, deal nurturing.

- Premium: US$49/user/month (billed annually) - more advanced: lead routing, e-signatures, AI email tools.

- Ultimate: US$69/user/month (billed annually) - highest tier: deep security, sandbox testing, enhanced support.

Strengths & ideal use cases

- Sales teams that prefer visual pipeline management.

- Organizations that want a simple, salesperson-friendly CRM without heavy overhead.

- Companies that need basic automation + deal tracking, but don’t need the complexity of enterprise CRMs.

Trade-offs

- Not as deep on forecasting or complex custom objects.

- Automation has limits in lower tiers.

- Advanced features (like e-signature) only in mid-to-high plans.

8. Freshsales / Freshworks CRM - AI + integrated communication

Freshsales (part of Freshworks) consolidates email, phone calls, and lead activity into a unified CRM workspace. Reps can call directly from the CRM, log activities, and automate follow-ups. The Freddy AI engine helps with lead scoring, prediction of deals, and suggesting tasks.

You can set up sales sequences (automated touchpoints), workflows, and even predictive forecasts based on historical behavior. Freshsales supports multichannel communication, meaning you don’t need separate apps for calling, emailing, or tracking.

Pricing

Freshworks provides tiered pricing (per user), though exact pricing may vary:

- Free tier: $0 / user - basic contact management.

- Growth: ~$11/user/month

- Pro: ~$47/user/month

- Enterprise: ~$71/user/month

Strengths & ideal use cases

- Sales teams that want built-in calling and email in their CRM.

- Businesses that want to leverage AI to prioritize deals and tasks.

- Smaller to mid-sized teams that want to implement quickly without stitching together separate tools.

Trade-offs

- Not as customizable as heavy-duty CRMs.

- AI features are more useful when you have a decent volume of data.

- Scale may require tier upgrades for better predictive capabilities.

9. Microsoft Dynamics 365 Sales - Enterprise, Microsoft-First CRM

Dynamics 365 Sales integrates natively with Microsoft 365 tools (Outlook, Teams, Excel) to embed sales workflows into the systems many companies already use. Salespeople can see deals and tasks from inside Outlook, collaborate in Teams, and pull data from Excel.

Dynamics supports territory management, role-based access, and detailed forecasting. You can build bespoke sales processes, automate tasks, track pipeline health, and use Microsoft’s AI insights to analyze deal risk and customer engagement.

Pricing

- Sales Professional: ~$65/user/month (annual)

- Sales Enterprise: ~$105/user/month

- Sales Premium (with Sales Insights): approx. $150+/user/month (includes additional AI and analytics)

Strengths & ideal use cases

- Enterprises already invested in Microsoft 365 / Azure.

- Teams that want deep integration with Outlook and Teams for collaboration.

- Sales orgs that need robust forecasting and security structure.

Trade-offs

- Licensing models can be complex.

- Needs effort to configure to match your sales process.

- Might be overkill for very small or early-stage sales teams.

About the author

Brendan Connaughton|Head of Growth Marketing

Brendan heads up growth marketing and demand generation at Qwilr, overseeing performance marketing, SEO, and lifecycle initiatives. Brendan has been instrumental in developing go-to-market functions for a number of high-growth startups and challenger brands.