Life Insurance Proposal Template

Present personalized coverage options with the Life Insurance Proposal Template – emphasize policy benefits, premiums, and tailored solutions.

About this template

Present tailored life insurance solutions with our Life Insurance Proposal Template. Designed to showcase policy options, benefits, and pricing, this template simplifies the proposal process and helps you close more deals.

Guide your clients through the complexities of life insurance with a user-friendly template that highlights the advantages of your offerings. Our Life Insurance Proposal Template enables you to provide customized solutions that instill trust and confidence in your clients.

What's included?

- Introduction

- State of the life insurance industry

- About us

- The life insurance you need

- Popular life insurance myths

- Pricing structure

- Get started

Included in our template

Introduction

A strong opening sets the tone for the entire client relationship. The introduction section helps you establish credibility, outline the client’s needs, and position your agency as a trusted advisor. Instead of starting from scratch, you’ll have a ready-made framework that communicates professionalism and reassures clients they’re making the right choice in choosing you for their life insurance coverage.

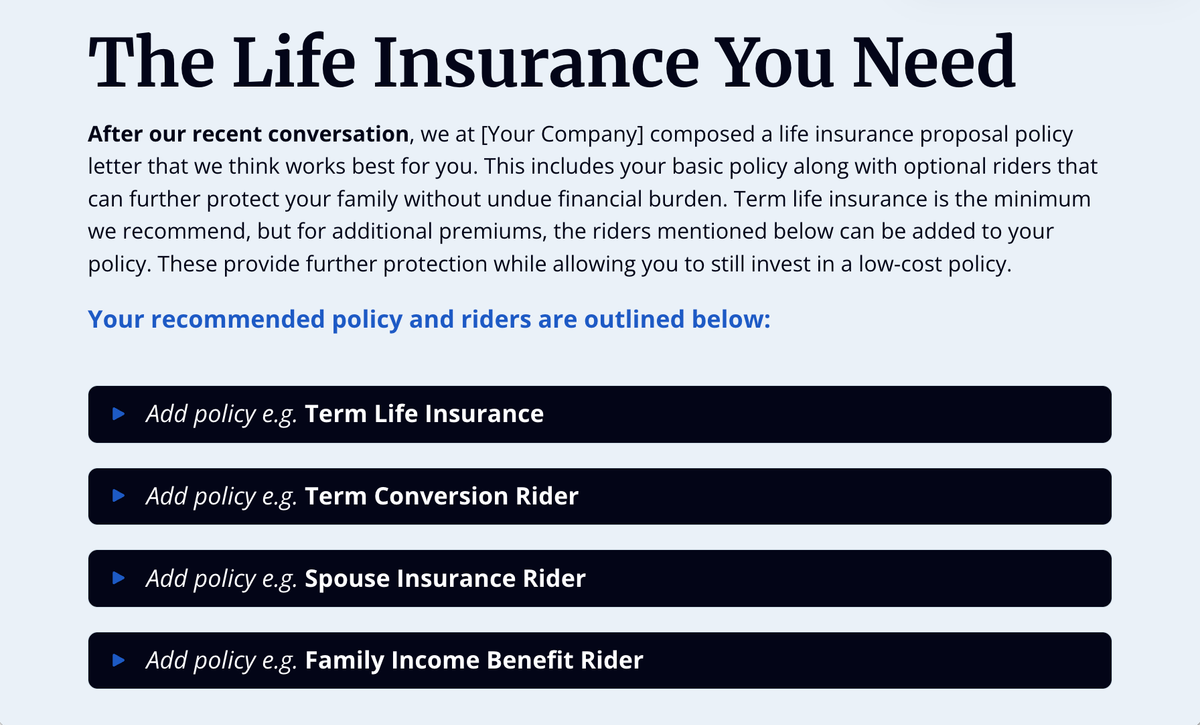

Policy details

Clients need clarity when comparing life insurance options. This section provides a streamlined way to present policy details—such as term life, whole life, or universal life—in a side-by-side format that’s easy to understand. By organizing benefits, coverage levels, and features in a professional layout, you make it simple for clients to evaluate choices and feel confident about selecting the right plan for their future.

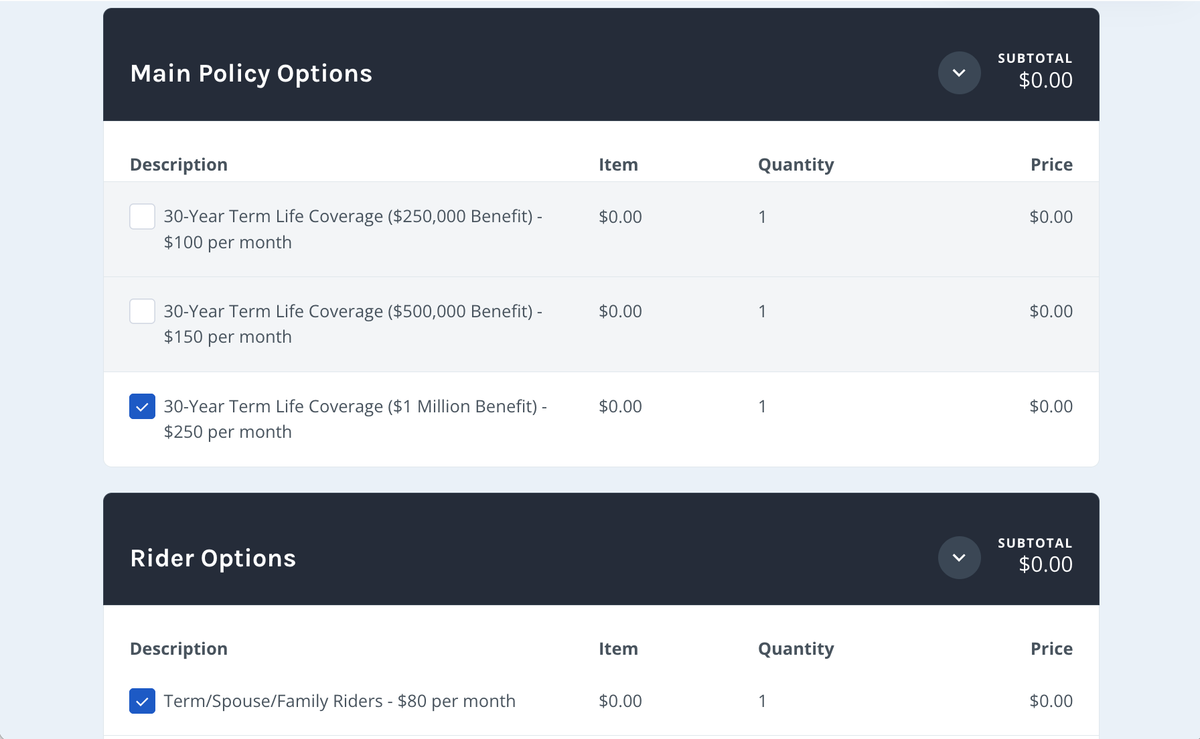

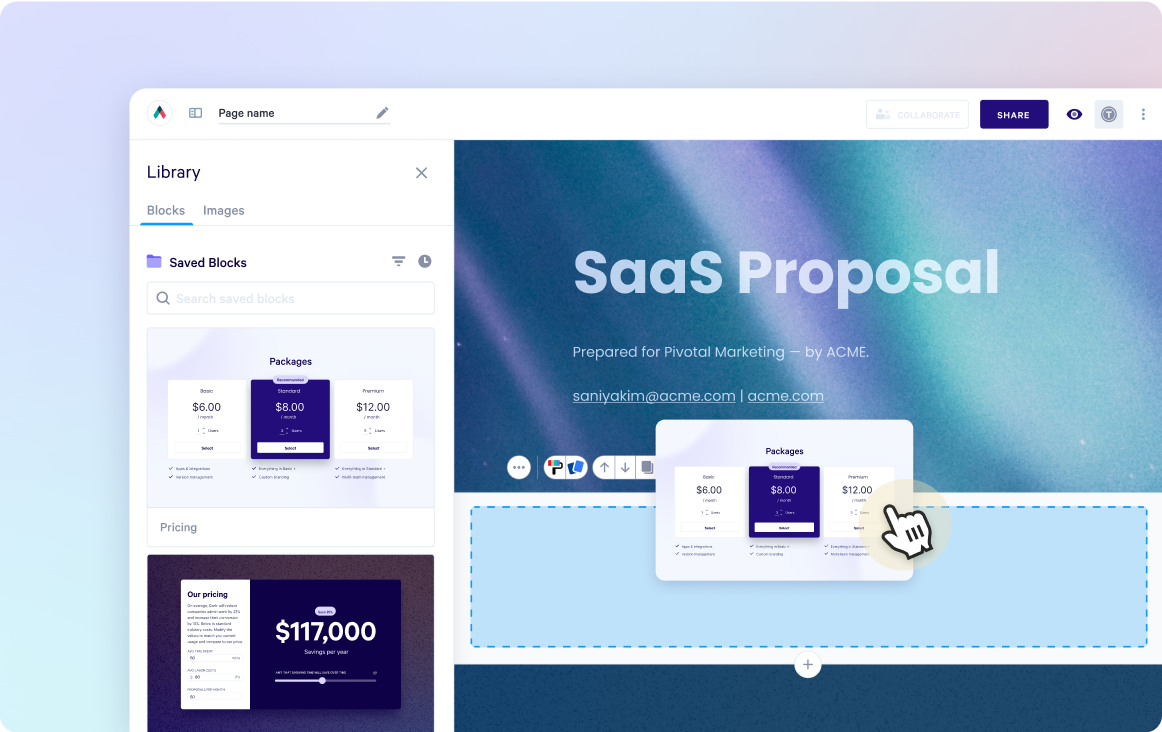

Interactive pricing structures

When it comes to life insurance, transparency is everything. Qwilr’s template includes interactive pricing tables that allow clients to explore premium options, payment frequencies, and add-ons directly within the proposal. This interactive experience builds trust, reduces confusion, and helps clients see how different policies fit within their budget. By simplifying complex pricing conversations, you make the decision-making process faster and easier.

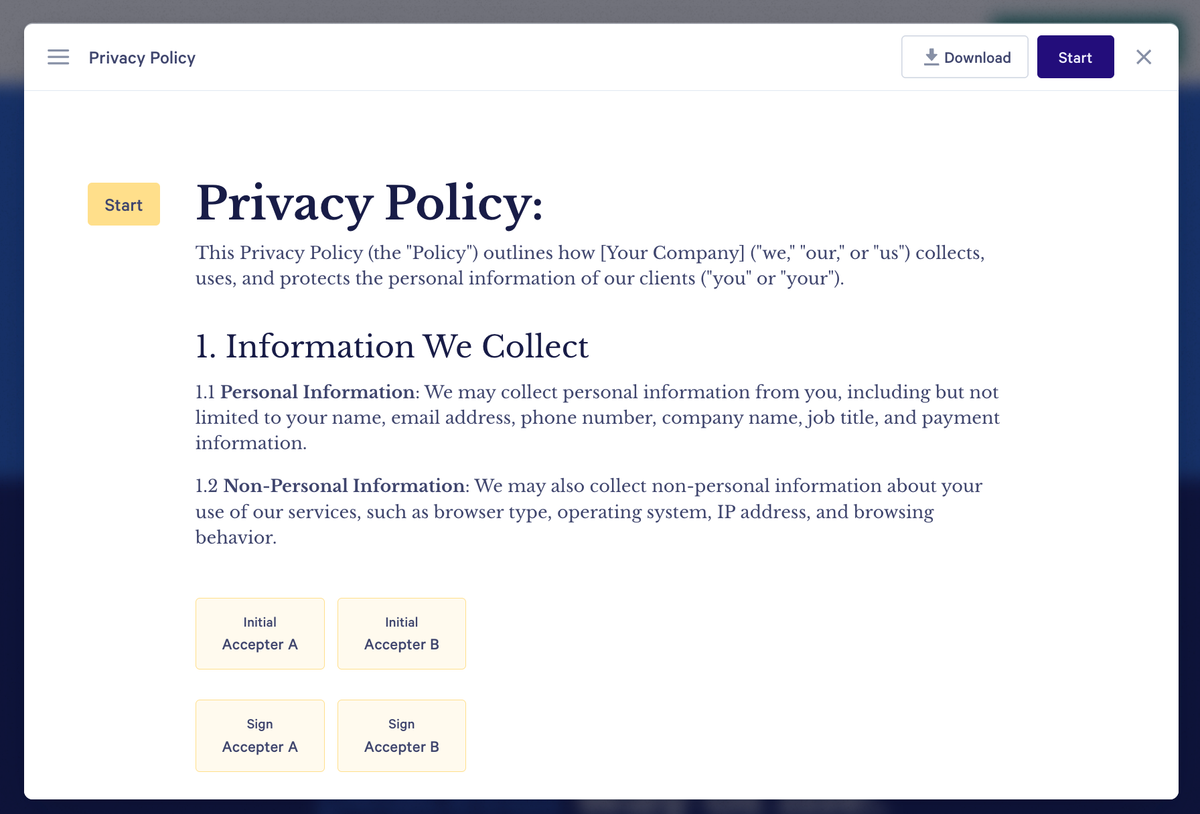

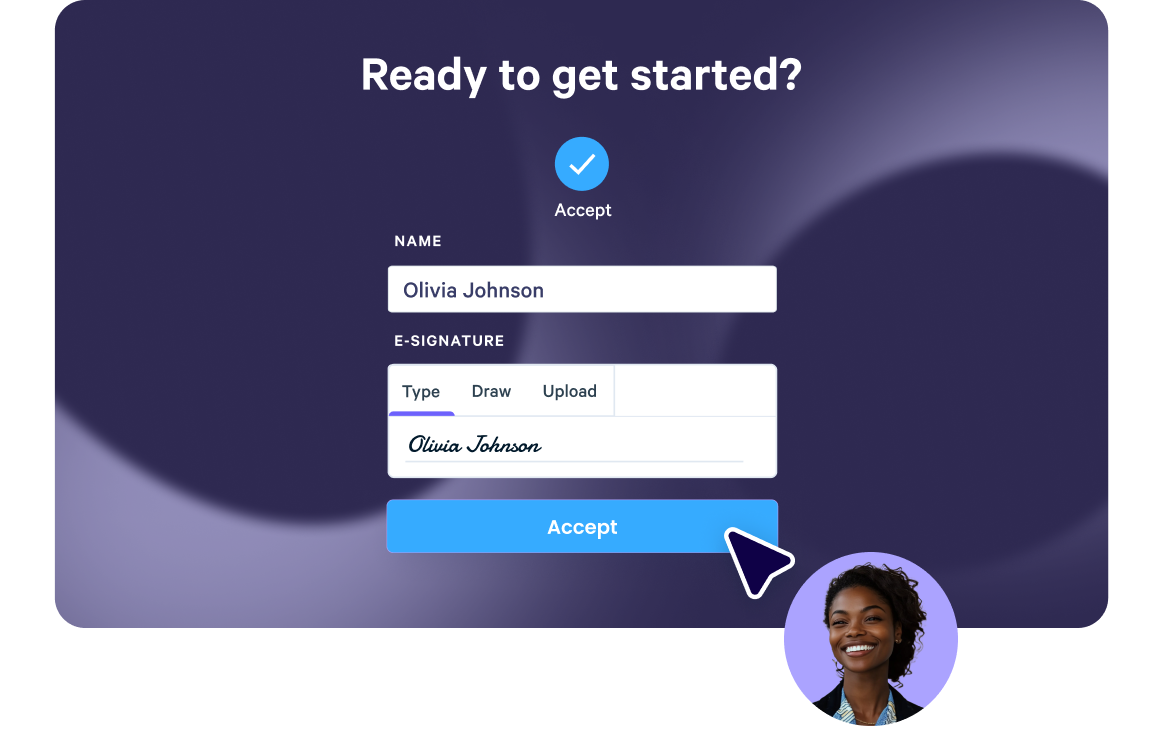

Customizable formal agreement and e-sign

Closing a life insurance deal shouldn’t be slowed down by paperwork. The agreement and accept block turns your proposal into a contract-ready document where clients can review terms and sign digitally. This seamless experience eliminates friction, accelerates the sales cycle, and ensures you secure commitments quickly and professionally.

Why Qwilr?

Design interactive proposals

Impress buyers with interactive proposals that stand out. Qwilr’s drag-and-drop editor makes it easy to create on-brand, stunning collateral — no design skills needed. Add videos, dynamic pricing, and ROI calculators to deliver a unique experience, while automated brand customizations ensure every proposal looks professional.

Built-in e-sign functionality

Combine stunning proposals, plain-text agreements, and secure e-signatures in one tool. Add print-friendly agreements alongside dynamic content and collect legally compliant e-signatures with ease. Track progress, capture multiple signatures, and close deals faster with Qwilr’s integrated e-sign functionality.

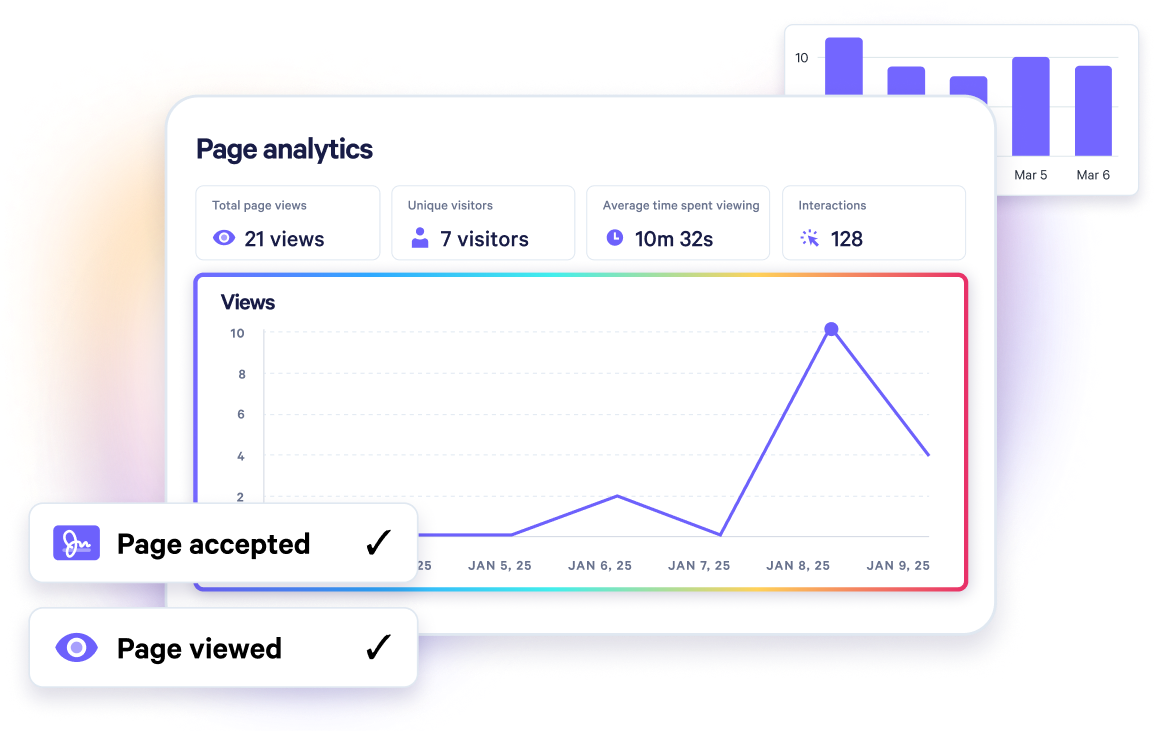

Real-time proposal analytics

Qwilr’s analytics provide full visibility into buyer engagement. Track when proposals are opened, signed, or shared, and get instant notifications for key buyer activities. See what buyers click on, how they engage, and prioritize follow-ups based on real-time insights—all designed to help close deals faster.

Templates for every use case

Explore templates for sales, marketing, customer success, sales enablement and more.

Explore proposal templatesFrequently asked questions

A standard life insurance contract usually contains these key elements:

- Premium: The amount paid by the policyholder to the insurance company to maintain coverage.

- Coverage Amount: The amount that will be paid out by the life insurance company to the policyholder's beneficiaries upon the policyholder's death.

- Beneficiaries: The person or people who will receive the payout upon the policyholder's death.

- Riders: Optional policy add-ons that can provide additional benefits, such as term conversion or an accelerated death benefit.

- Exclusions or Exceptions: Any conditions or events that might void the policy's coverage. For example, any deaths related to reckless driving or suicide may not be covered under the policy.

An effective life insurance contract should ideally have the following characteristics:

- Clarity: The terms and conditions should be clear and straightforward for the policyholder to understand.

- Transparency: There should be no hidden fees or clauses that could affect the policyholder's coverage.

- Flexibility: The policyholder should have the flexibility to modify or adjust their coverage as their needs change over time.

- Comprehensive Coverage: The policy should provide comprehensive coverage that suits the policyholder's specific needs and requirements.

Yes, it is possible to create a custom life insurance proposal in Qwilr. You can do this by using the Qwilr template as a starting point and customizing it to meet the specific needs of your clients. You can add or remove sections, update the content, and brand the document to match your company's tone and style.