The playbook

Level up your sales strategy, management approach and tactics.

Featured posts

All posts

8 mins

10 Key Benefits of Document Automation for Businesses

Brendan Connaughton|Jul 7, 2025

Sales techniques•8 mins

How to Reduce Proposal Creation Time Without Losing Quality

Brendan Connaughton|Jul 7, 2025

Sales techniques•12 mins

Playbook: How to Automate Business Proposals With Qwilr

Taru Bhargava|Jun 30, 2025

Sales management•22 mins

The Death of Static Proposals: What 1M Proposals Taught Us

Jess Tassell|Jun 24, 2025

Sales management•8 mins

Proposal vs Invoice: Can You Combine Them?

Brendan Connaughton|Jun 23, 2025

Marketing•32 mins

14 Best B2B Marketing Tools for the Ultimate Tech Stack in 2025

Marissa Taffer|Jun 20, 2025

Sales techniques•12 mins

Insight Selling: Win Deals By Thinking Before The Buyer Does

Brendan Connaughton|Jun 18, 2025

Sales management•13 mins

How to Master Proposal Management by Thinking Like an Investment Manager

Taru Bhargava|Jun 18, 2025

Sales management•14 mins

Sales Workflow: How to Fix Inconsistent Rep Performance

Taru Bhargava|Jun 6, 2025

Marketing•11 mins

How to Write a Winning Fundraising Proposal

Brendan Connaughton|Jun 3, 2025

Sales management•11 mins

How to Write a Compelling CRM Proposal for 2025

Brendan Connaughton|Jun 3, 2025

Sales techniques•10 mins

How to Write a Compelling Brand Collaboration Proposal

Dan Lever|Jun 3, 2025

Sales management•14 mins

The Formal Quote: A Guide to Getting It Right

Dusty Martin|May 30, 2025

Sales management•13 mins

Sales Quote Automation: How to Send Professional Quotes in Minutes

Kiran Shahid|May 30, 2025

Sales tech•11 mins

Docusign Pricing: Is the Juice Worth the Squeeze?

Brendan Connaughton|May 29, 2025

Sales management•16 mins

The Art of Bundle Pricing

Dusty Martin|May 27, 2025

Product updates•2 mins

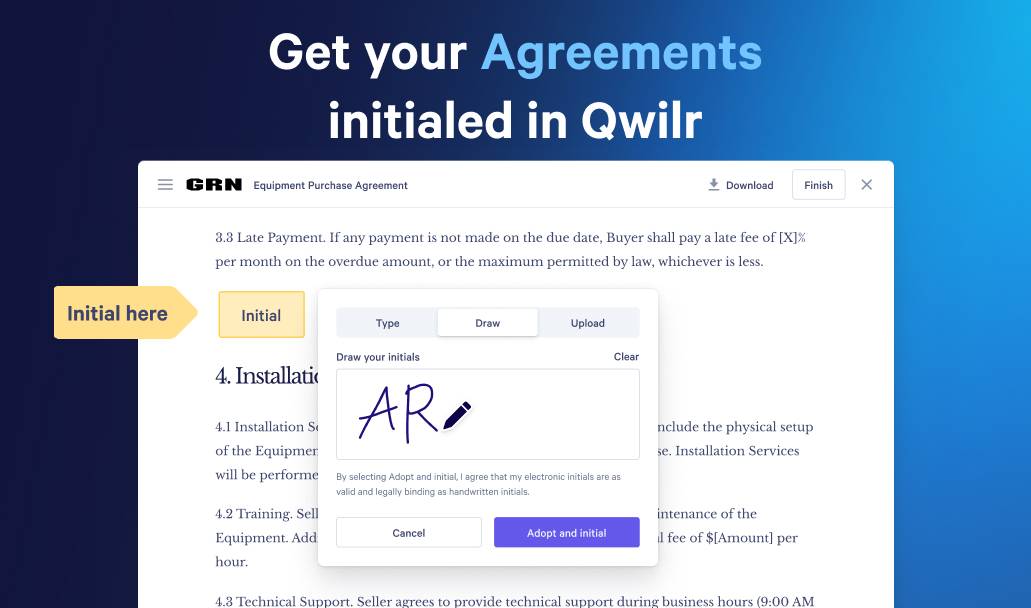

NEW: Get your agreements and contracts initialed in Qwilr

Guy Hall|May 26, 2025

Product updates•3 mins

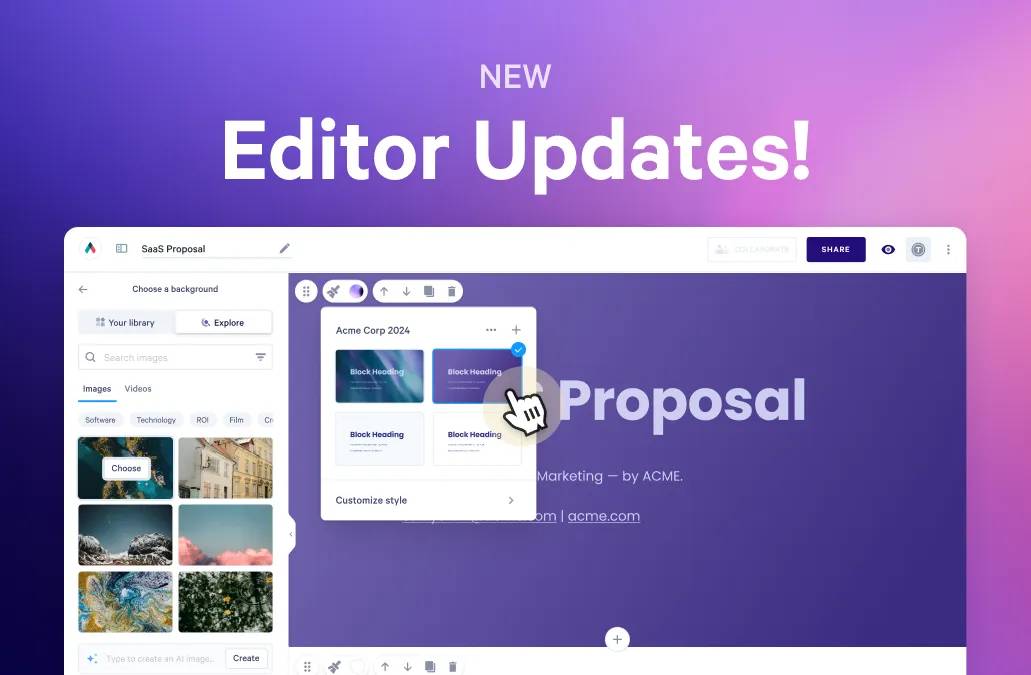

NEW: It’s easier than ever to produce impressive proposals in Qwilr

Guy Hall|May 26, 2025