Starting a new partnership is exciting and nerve-wracking at the same time. You’re ready to go into business together, but you want to make sure you outline the terms of your partnership clearly and cleanly. The boundaries you build now will make or break your professional relationship down the line.

For this reason, figuring out the right way to write a partnership agreement is crucial. This article will provide everything you need to get that done the right way.

Key Takeaways

- A partnership agreement is a legally binding document that outlines the roles, responsibilities, shares, and liabilities of partners in a business.

- Every partnership should have a written agreement that all partners sign to protect the business and the partners.

- Working with a template, like the ones offered by Qwilr, helps guide partners through each section of the agreement seamlessly.

What is a partnership agreement?

A partnership agreement is a legally binding document created to establish the parameters of a partnership. It typically includes the percentages of ownership, liability, profits, and losses, and even a plan for potential dispute resolution.

It helps you structure your business, plan for quarterly business reviews, and outline authorities.

Without this document, partners, and the business can face complicated and expensive risks that could involve the dissolution of the company as a whole.

When you clearly outline the rights and responsibilities of each partner, you lay the foundation for a solid business that all parties enter with open eyes and defined roles.

The different types of partnership agreements

Depending on the kind of business you have and how you run it, you can choose from among several different types of partnership agreements.

General partnerships

The general partnership agreement is the most common because it is relatively easy to put together and doesn’t require a formation filing fee, franchise taxes, or ongoing state fees.

The agreement shares responsibilities for the management of the business and all partners have equal access to decision-making, the formation of business contracts, the creation of sales contracts, and taking out loans for the business. All partners are also responsible for the company's total liability.

Limited partnerships

Conversely, in a limited partnership, all partners do not share total liability. Instead, some partners assume more responsibility than clothes. This is typically because one or more partners are more involved in the day-to-day tasks or more heavily invested financially.

In any event, limited partnerships allow full partners to have full liability and limited partners to remain free from legal responsibilities in terms of debts. That means limited partners won’t find their personal assets tied up in the business. Further, full partners don’t need to consult limited partners when it comes to making decisions.

Limited liability partnerships

Limited liability partnerships are less common than general or limited partnerships because the structure is highly specific. You’ll often see these kinds of partnerships drawn up by business offices with autonomous professionals like doctors, therapists, dentists, or attorneys. These partnerships allow all partners to be fully responsible and liable for the total business. At the same time, each partner is not responsible for the errors made by another partner.

The highlight is that each partner can be a co-owner of the business without being liable for their partner’s errors.

Note that this type of partnership is not legal in all states, so be sure to check your state partnership laws.

Limited liability limited partnerships

Another partnership not legal in all states is the limited liability limited partnership. This is most common among real estate businesses, where some offices have both full and limited partners, or some invest more heavily and others contribute less financially.

In this agreement, even full partners can be protected from business liabilities, protecting their investment and ensuring their biggest loss will only ever be the initial investment. Check with your state laws to see if this partnership is an option for your business.

When should you use a partnership agreement?

Any time two or more people decide to go into business together, you should draw up a partnership agreement. Even if you just draft a general agreement that outlines the roles, responsibilities, and liabilities of each party, you can keep it simple and get everything on paper.

While you may think the good old fashioned “handshake agreement” is plenty now, down the line, in the event of disputes, you’ll likely wish you had something on paper, complete with legally binding e-signatures.

After all, it can’t hurt to get it all in writing, but it can hurt not to.

A partnership agreement is a contract between all partners, and it can actually help avoid disputes in the future because the roles and responsibilities are so clearly defined.

How to draft a partnership agreement: What to include

It’s not difficult to write a partnership agreement, but you might need some help remembering all the elements involved, which is why it often helps to have a partnership agreement template to work with. Here are the basics to include in every partnership agreement.

Specify the partners

The first thing you’ll do when you draft a partnership agreement is define the structure of your business and partnership. This will involve a description of the type of partnership you’re forming, who each partner is, and what the role of the partner is. You’ll want to state clearly if they’re a full partner, a limited partner, or if you’re forming a corporation or a trust.

You should also include in this section:

- The name of your business

- The type of business entity

- The place of your business, including the address of the main office

- The names of the partners

- The date the partnership begins

It’s also a good idea to state where your business activities occur — the region, county, city, state, or country.

Percentage of ownership

Next, you’ll need to write out how much of the business each partner owns. Make your percentages clear, and include the reasoning for this decision.

You’ll often consider how much a partner contributes financially, how much “sweat equity” each partner will put in, and how much responsibility each partner expects to take on. You can describe these in further detail in the coming sections.

Be sure the total percentage of all partners comes to 100%.

Capital contribution

This section is an obvious follow-up to the percentage section as it explains how much each partner contributes to the business at its onset and going forward.

You can outline how much work each partner does and what kind of work, as well as how much of a financial investment each partner is contributing to get the business up and running.

If there are other assets going into the business, like office space or equipment, be sure to include that here as well.

Profit and loss division

Next, you’ll divide expected profits and losses among the partners. This section will break down what each partner is allowed to withdraw from their profit of the business as well as how much loss they share.

Profit and loss division is critical for fairness, transparency, and proper financial management. With this section clearly outlined, there can be no arguments over who gets what, when, and why.

You can even include the reasoning behind the “why” in your agreement's profit and loss division section. This might be a good time to include an interactive ROI calculator that clearly shows the expected returns on each partner's investment.

Liability shares

Depending on what kind of partnership you’ve established, you’ll want to outline in this section specifically how much liability each partner has in the business. For example, if you’ve got an LLC (limited liability limited) partnership, you’ll define clearly whether each partner is liable for the other partner’s mistakes, like malpractice suits, etc.

The language in this section should help business partners understand exactly how losses could occur and who will be held accountable in the event the losses arise.

Decision-making division

Now that all parties are clear on who profits, how, and who’s liable for what, it’s time to clarify decision-making. You can establish roles for each partner here, explaining in detail what is expected of each partner, what kinds of decisions they can and can’t make, and what decisions require all or most partners.

Each partner must agree on the following:

- A schedule for partner meetings to review business reports and more

- How to call special meetings

- Methods for voting and vetoing

- Which partners take care of daily business interests

- Which partners have the authority to sign contracts on behalf of the business

Duration of partnership

This section is fairly simple. It can detail a specific end date for the partnership or state clearly that the partnership will continue until one or more parties decide to depart. While it might seem obvious, it is still an important part of a partnership agreement.

Partnership agreement template

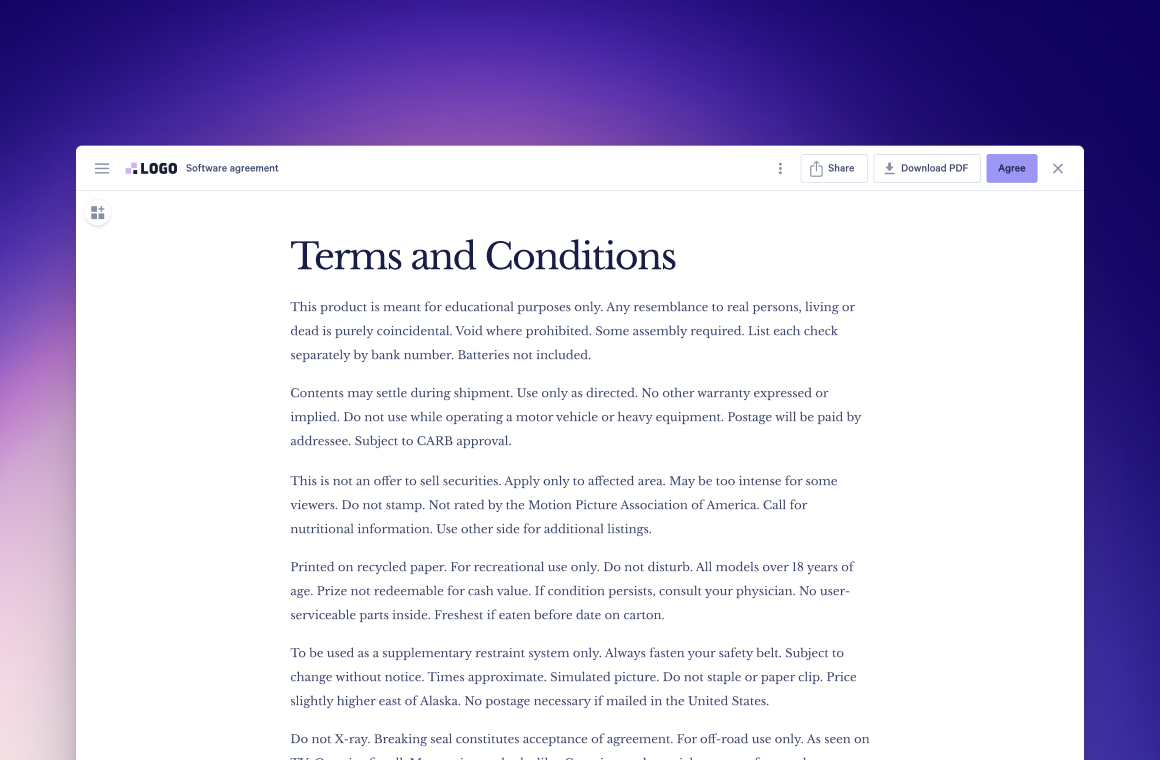

The partnership agreement template at Qwilr gives you the perfect structure and plenty of freedom to make it your own.

You can add your own logo, change fonts, and include features like e-signatures to keep your agreement legal and binding, protecting all parties involved.

You can also add security features like password protection and set up permissions so your team can access only what they need.

Need something a little more formal? Qwilr has it handled. The agreements feature allows you to attach a plain-text, formal agreement to your engaging partnership proposal.

Simply choose to ‘add agreement’, write up the contract from a template or from scratch and include it in your proposal. Partners can then accept and sign all on a web-based document.

About the author

Brendan Connaughton|Head of Growth Marketing

Brendan heads up growth marketing and demand generation at Qwilr, overseeing performance marketing, SEO, and lifecycle initiatives. Brendan has been instrumental in developing go-to-market functions for a number of high-growth startups and challenger brands.