Commercial Insurance Proposal Template

Our Commercial Insurance Proposal Template is designed to protect businesses and captivate potential clients. It offers custom insurance solutions to tackle specific business risks and ensure extensive coverage.

About this template

Safeguard businesses and impress potential clients with our comprehensive Commercial Insurance Proposal Template. Crafted for precision and impact, this template allows your team to present tailored insurance solutions that address specific business risks and provide robust coverage.

Showcase the advantages of your commercial insurance services, such as risk mitigation, financial protection, and regulatory compliance, helping businesses thrive with confidence and security. With our proposal template, win over clients by demonstrating your commitment to their business continuity and success.

What's included?

- Introduction

- Understanding risk environment

- Coverage strategy

- Service and support framework

- Performance & KPIs

- Investment and pricing models

- Success stories

- Implementation timeline

- Next steps

Why Qwilr?

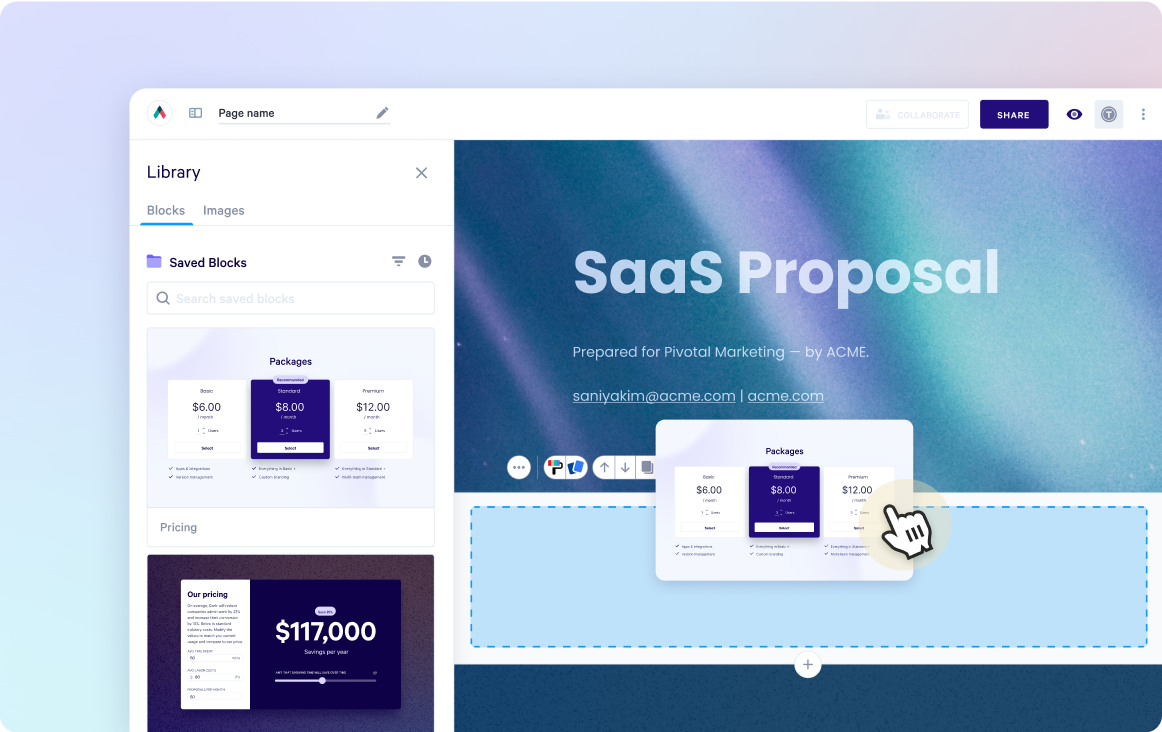

Design interactive proposals

Impress buyers with interactive proposals that stand out. Qwilr’s drag-and-drop editor makes it easy to create on-brand, stunning collateral — no design skills needed. Add videos, dynamic pricing, and ROI calculators to deliver a unique experience, while automated brand customizations ensure every proposal looks professional.

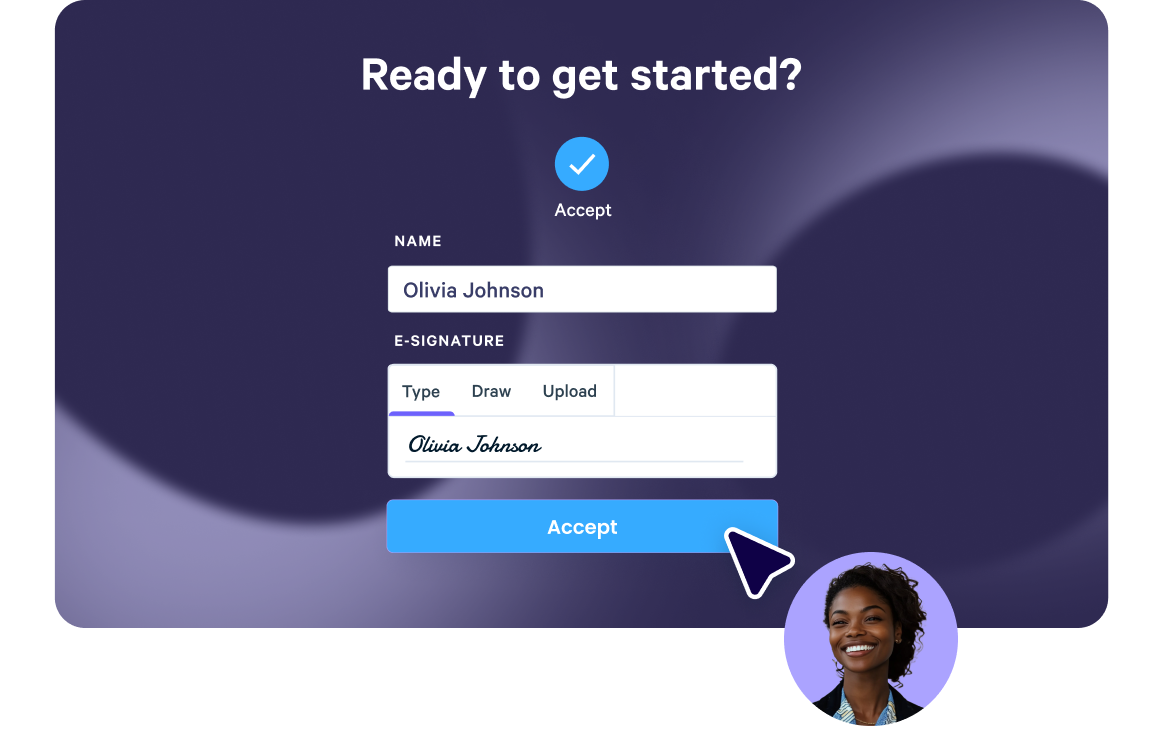

Built-in e-sign functionality

Combine stunning proposals, plain-text agreements, and secure e-signatures in one tool. Add print-friendly agreements alongside dynamic content and collect legally compliant e-signatures with ease. Track progress, capture multiple signatures, and close deals faster with Qwilr’s integrated e-sign functionality.

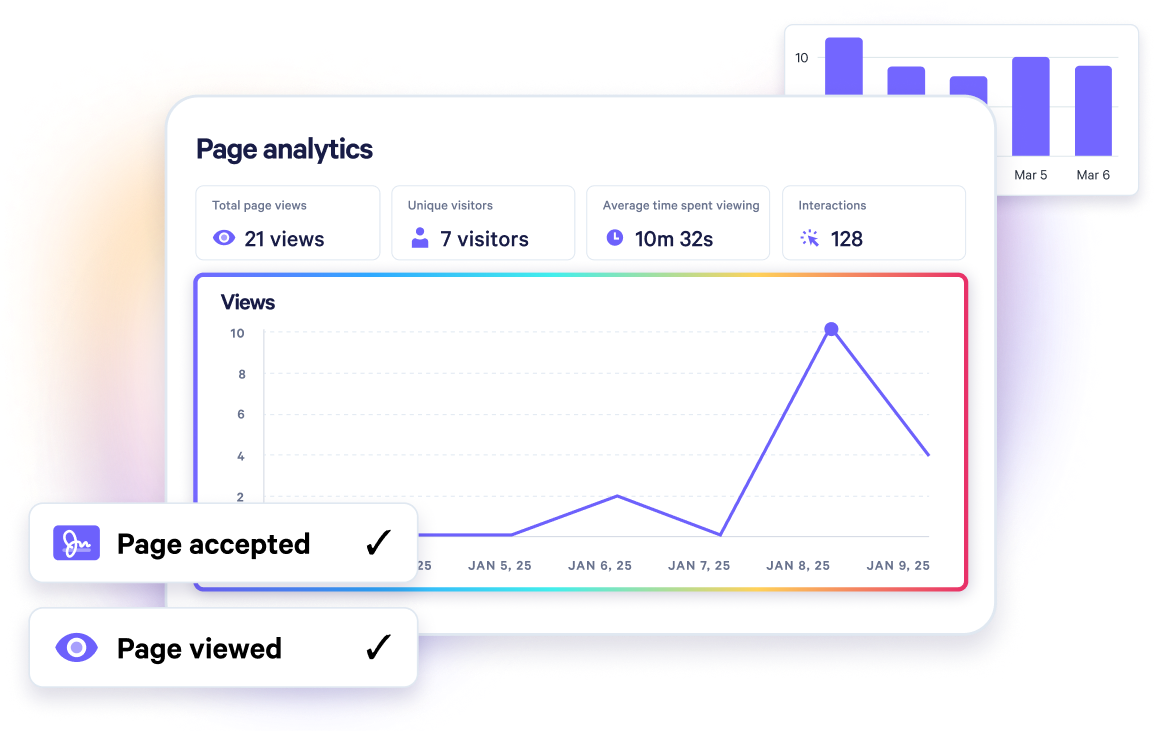

Real-time proposal analytics

Qwilr’s analytics provide full visibility into buyer engagement. Track when proposals are opened, signed, or shared, and get instant notifications for key buyer activities. See what buyers click on, how they engage, and prioritize follow-ups based on real-time insights—all designed to help close deals faster.

Templates for every use case

Explore templates for sales, marketing, customer success, sales enablement and more.

Explore proposal templatesFrequently asked questions

A Commercial Insurance Proposal Template is a pre-formatted document that outlines the terms and conditions of a proposed commercial insurance policy. It is used by insurance providers to present their insurance products to potential clients.

A Commercial Insurance Proposal Template helps streamline the process of creating a proposal for commercial insurance. It ensures all necessary information is included and presented in a professional manner, increasing the chances of securing a policy.

You can customize your Commercial Insurance Proposal Template by adding your company's logo, changing the color scheme, and modifying the text to suit your specific needs and preferences.

A Commercial Insurance Proposal Template should include information such as the name of the insurance provider, the type of coverage offered, the terms and conditions of the policy, the premium amount, and any exclusions or limitations.